Making ESG work for the agricultural sector

Agribusinesses can maximise opportunities and promote resilience by adopting ESG strategies, according to Lerato Molefi, Associate, and Dalit Anstey, Knowledge Lawyer, from Webber Wentzel.

Disruption, reinvention and inclusive leadership: how can we use the opportunity...

Judith Haupt, Managing Director at Contract South Africa, states that the business environment is being reshaped due to social trends. It is important that we realise that these trends pose both big risks and opportunities to rethink our work and our world fundamentally.

Limiting medical aid increases isn’t the answer

Gary Feldman states that private healthcare systems are not sustainable in its current format. Feldman calls for a review of both the private and public healthcare systems in order to come up with a system that allows all South African access to affordable and decent healthcare.

Intelligence: the emotional and the artificial

Emotional intelligence gives us the edge that will allow us to coexist and not resist artificial intelligence.

The art of estate planning

The role of a multi-family office in preserving wealth and protecting family legacies.

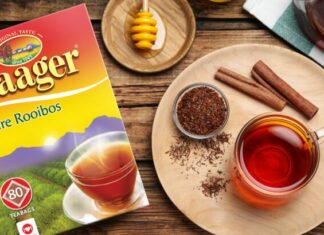

The status of Rooibos is internationally protected

The popular tea that is really a herb has a number of surprising qualities. Rooibos specialist Joekels shares 13 fast facts about South Africa’s beloved brew.

Technology and the customer experience

Francois du Toit, the CFP and founder of PROpulsion provides advice to financial advisors and planners who want to keep up with the significant transformation of the financial planning industry.

Get back on track, in four strategic steps

Karl Smith, Senior education, training and member support manager at SAIPA outlines the benefits of small businesses approaching Professional Accountants (SA) for advisory support.

Nature’s Dividend: investing with impact to tackle the dual climate and biodiversity...

Diane Laas and Rob Stewart, Global Impact Fund Managers at Melville Douglas, discuss how to invest with impact to target both the climate and biodiversity crises.

Most Popular

What are the different types of structured products available to retail and institutional investors...

There is a limited range of structured products offered in South Africa compared to the rest of the world.

The 2026 guide to structured products in South Africa

Exclusive: The 2026 Structured Products Guide is now available as an eBook. This guide features a range of highly informative introductory articles about structured products in South Africa and provide profiles of leading companies offering structured products in South Africa.

Is everything becoming AI – and how can you respond without selling equities?

How can investors guard against the concentration risk of the technology/AI narrative without giving up equity exposure?

What is a structured product?

Structured products can offer investors a unique way to access market returns while managing risk with capital protection and tailored pay-offs. These innovative investments have evolved and can now offer the potential for enhanced or geared returns, with partial capital protection. Investors must weigh the trade-offs against the gains.

Digital Transformation Summit – South Africa 2026

Bringing together 200+ C-level executives, CIOs, CTOs, technology leaders, policymakers, and digital decision-makers, the summit is set to take place on 11th March 2026 at the Indaba Hotel, Spa and Conference Centre.