Record of advice: various definitions often lead to misinterpretation

Anton Swanepoel, Founder of Trusted Advisors, states that some advisors refer to the client proposal as the record of advice and others refer to a quotation as the record of advice, both of which are only partially correct.

A Coaching Way of Being

Blue Chip explores the role of coaching in unlocking financial potential. Behavioural coaching expert, Rob Macdonald, unpacks what it is and why it is important to the work of a financial planner.

Choose your poison

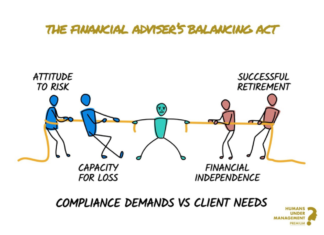

According to Any Hart, Founder of Humans Under Management, financial advisors must champion their clients’ futures, confronting misguided compliance systems that obscure the real risks – capital loss, inflation, and poor returns – while working towards a framework that truly safeguards financial well-being.

CoFI: the need to solve an age-old conundrum

Anton Swanepoel, Founder pf Trusted Advisors states that the client engagement and compliance process has posed a “conundrum” for financial service providers for decades.

Essential habits of highly successful FSPs under COFI

This article was inspired by legendary author, the late Stephen R Covey, whose bestselling book, The Seven Habits of Highly Effective People, impacted millions of...

Most Popular

How flexible and customisable should a DFM offering be?

As DFMs grow in scale and influence, the debate around flexibility and customisation in their investment offerings intensifies.

Meet the Managers 2026

Meet the Managers is considered the “Ted-Talk” in investment management, where financial advisors can access a vast array of investment managers, covering all types...

Offshore investment gains momentum in SA

Blue Chip speaks to Hymne Landman, CEO at Momentum Wealth, about offshore investing for South Africans.

VISION 2030

Blue Chip speaks to the Financial Planning Institute of Southern Africa’s CEO, Lelané Bezuidenhout, about winning the FPSB 2025 Noel Maye Award for outstanding contributions to the profession as well as the FPI’s new Vision 2030 strategy.

Protecting independent financial advice

The Financial Intermediaries Association of South Africa’s primary purpose is to guard, develop, promote and represent professional advisory and intermediary businesses in the financial services industry. Blue Chip speaks to Lizelle van der Merwe, CEO of the FIA.