This article was inspired by legendary author, the late Stephen R Covey, whose bestselling book, The Seven Habits of Highly Effective People, impacted millions of people around the world. Business owners, managers, key individuals, compliance officers and supervisors will do very well to consider the habits highlighted here. As a quick reminder, Covey asserted that the following personal habits would lay the foundation of success:

1. Be Proactive

2. Begin with the End in Mind

3. Put First Things First

4. Think Win-Win

5. Seek First to Understand, Then to Be Understood

6. Synergise

7. Sharpen the Saw

When I pondered on the impact that the Conduct of Financial Institutions (COFI) Act, when promulgated, will have on financial service providers (FSPs), I was reminded of the time when the Financial Advisory and Intermediary Services Act (FAIS) became effective on 30 September 2004.

I remembered that, as an industry, we were not fully prepared for the impact that market conduct legislation would have on FSPs. Some people may disagree with my assessment, but even after almost 19 years, I have witnessed how many FSPs, if not most, are still struggling to fully comply with FAIS and its subordinate legislation.

Over the last few months, I have conducted a few informal and even some formal surveys and found that more than 90% of leading firms in South Africa have not had the time or capacity to read the FSR Act and the COFI Bill. If that is any indication of leading FSPs in South Africa, I believe that the figure will be much higher for average firms. I highlight this statistic, not to judge, but to create awareness that the majority of FSPs are still unaware of how COFI will affect their businesses soon.

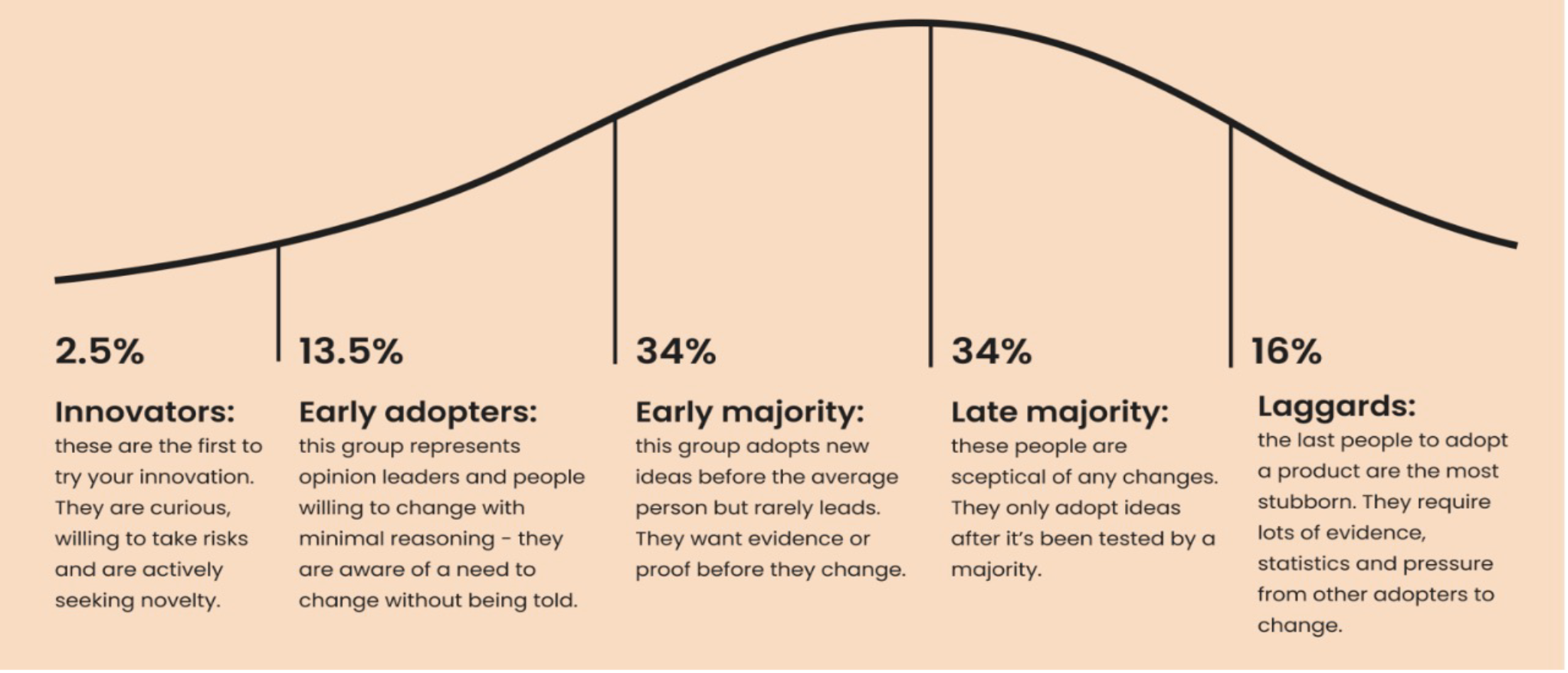

There are many valid mitigating factors that contribute to the current level of unawareness, but with these statistics, it seems that we are heading for a FAIS déjà vu. As the promulgation of the COFI Act draws near and evaluating how many FSPs will be ready for the implementation of the COFI Act, I believe that we will see a similar curve to the one above, with some minor adjustments.

For those who pride themselves on always being ahead of the curve, I am confident that the following habits, in a slightly different order than those proposed by Covey and adding a few, will inspire you to stay at the cutting edge of the industry under COFI:

1. Define reality and be proactive

The reality is that we are living in a world where legislation is here to stay. As hard as it may seem, and I do not mean any disrespect, either make peace with legislation and seek proactive and innovative ways to incorporate it into your business or I am afraid that the financial services industry will no longer be for you.

In previous articles I have highlighted that FSPs find themselves in extreme conditions, but in the words of Epictetus, the Greek Stoic philosopher, “It’s not what happens to you, but how you react to it that matters.” According to Jack Canfield, American author, corporate trainer and entrepreneur, “Successful people face facts squarely. They do the uncomfortable and take steps to create their desired outcomes”. The reality is that COFI is upon us, and it will impact your business. Best be proactive and start preparing for the next wave of regulatory reform.

2. Seek first to understand, then to be understood

Our industry is full of opinionated individuals, including me. Looking back, I am often ashamed of how many times I have been quick to express an opinion on a subject before fully understanding the context and its fundamentals. For any one of us to assume that COFI will simply be a “cut and paste” of FAIS will be a “mother of a mistake”.

A word of caution: assumptions about COFI based on uninformed opinions, regardless of decades of experience, may be the downfall of many FSPs. One thing is for sure – it is simply not going to be business as usual under COFI. Yes, there are many principles in FAIS that will be incorporated in COFI, but it will be necessary to reassess and stress-test your business and your client engagement process before conducting business under the new Act. My advice: seek first to truly understand the fundamentals of COFI before expressing an uninformed opinion and potentially leading your team in the wrong direction.

3. Begin with the end in mind

In my view, to establish and maintain a growing, profitable and sustainable business must be the ultimate goal of any FSP. Not only is financial soundness a regulatory requirement; your clients, your staff, the South African economy and your family depend on it. However, there are different ways to go about it. If money, and not clients, is your primary focus, I am afraid that your success may be short-lived.

According to business management gurus Peter F Drucker and Brian Tracey, the purpose of a business is to create and keep a customer. Therefore, all business activities should be centered around this central purpose. On the positive side, COFI contains multiple client-centred, best-practice business principles that will help you to attract and retain clients, which have always been fundamental to business success. If you begin with that in mind, you will be off to a great start.

4. Create order in the chaos and cement the fundamentals

With all the political agendas, economic instability, loadshedding and the ripple effects of Covid, only to name a few disruptions that we must deal with daily, and with more than 1 000 pages of legislation that FSPs will have to comply with, it is easy to think that we are living in a very demanding and even chaotic world. At least, this is how I feel many times. If you can in any way relate, it will be extremely important for you to create order in the chaos and to cement the fundamentals of your business.

COFI will be implemented in different parts over the next six to seven years, but like any building project that may take months or even years to complete, a sound foundation is essential. You can never build a great FSP business on a weak foundation. For those who are interested in pursuing this habit further, I published a free e-book titled, The fundamentals of practice management for representatives on LinkedIn earlier this year, which will provide you with more detail. These fundamentals will be essential for your business success under COFI and many of them can be implemented proactively, even before the implementation of the new Act.

5. Put first things first (prioritise)

I passionately believe in the Pareto (80/20) principle, which states that, for many outcomes, roughly 80% of consequences come from 20% of causes (the “vital few”). After two decades of studying market conduct legislation, at the risk of frustrating the Regulator and some of the compliance officers, I have concluded that not all regulations are equally important. There are some provisions that are essential (the vital 20%) that will meet the objectives of the legislation 90% of the time.

If ever there was a time for FSPs to identify the vital 20% of COFI and to build a strategy around it, it is now. Practically, COFI, read with the FSR Act and the conduct standards that will follow, the volumes of legislation, FICA and POPIA are so overwhelming, that FSPs will be left with no choice but to prioritise the key provisions in COFI that will establish a sound foundation for success in the future.

6. Synergise

Roughly 99% of advisors I speak to admit that the compliance process and packs of documents that must be completed, discussed, signed and uploaded for record-keeping purposes lead to negative advisor and client experiences. There are two vital components for creating a better advisor and client experience, namely innovation and technology. A new way of approaching compliance documentation with the vital 20% of content that will ensure 90% of achieving the outcomes of COFI, supported by technology, will enhance business efficiencies and ultimately improve the advisor and client experience.

7. Consider your approach to change management

With new legislation approaching, the first adjustment that you will have to make is a personal mental one. As one of the leaders in the business, you will have to guard your heart and your mind, because the last thing that your representatives and workforce need is a leader that communicates negativity. Change management will once again be a core leadership demand, and with COFI an increasingly vital one. A recent Gallup Work Experience Communication Survey found that employees who strongly agree that their leaders help them see how changes made today will affect their organisation in the future are significantly more likely to also strongly agree that their company has the speed and agility to meet customer and marketplace change and that they know what is expected of them.

The success of your business over the next few years will depend on your representatives’ and employees’ ability to adapt. In these challenging conditions it must be remembered that overworked, anxious people have limited capacity to absorb information about change, much less adapt to it or implement it effectively.

I would be surprised if your workforce does not experience high levels of stress, worry and possible burnout. Therefore, your approach to COFI and your change management strategy will be of fundamental importance in preparation for your FAIS to COFI journey. Your approach and communication strategy will offer a unique opportunity for you to establish new levels of trust in your leadership with your team.

8. Implement

One does not need a Gallup survey to know that 100% of businesses that fail to implement good strategies will not prosper. If you know that you need to start preparing for COFI, act on it. Be proactive. If you know that you need to seek to understand more – start. Begin with the end in mind. The late David Viscott, American psychiatrist, author, businessman and media personality, asserted that, “If you have the courage to begin, you have the courage to succeed.”

9. Sharpen the saw

As I mentioned before, COFI will be implemented in different parts over the next six to seven years, which means that you will have to stay on top of every change as and when they come. The good news is that, if you proactively created order in the chaos and laid a sound foundation for your business at the outset, the phases that will follow will be easier to implement to ensure a seamless transition from FAIS to COFI.

10. Create a culture of Kaizen

Kaizen is the Japanese word that means continual improvement. The habit of creating and maintaining the culture of Kaizen will ensure that you will continue to grow and increase the profitability of your FSP.