From unit trusts and ETFs to structured products, clients seek guidance on safety. The challenge lies in helping clients look beyond labels towards the underlying risk, regulation and appropriateness of each investment. The evolution of the South African retail investor has been shaped by regulatory progress, technology and product innovation. From an era when investment opportunities were primarily reserved for institutions and high-net-worth individuals, retail investors now enjoy direct access to a wide array of investment vehicles.

Investments are typically made through Linked Investment Service Providers (LISPs), stockbrokers or bank platforms. Unit trusts offer diversification, accessibility and a mature regulatory regime. The prevailing approach to portfolio construction often defaults to a collection of unit trusts rather than a blend of distinct strategies across different wrappers. But investing isn’t limited to one format. Nor should it be.

Safety in investing is an outcome of sound regulation, transparent design and investor understanding. It’s essential to appreciate that no investment is risk-free. What matters is whether the risks are appropriate for your goals and are managed effectively.

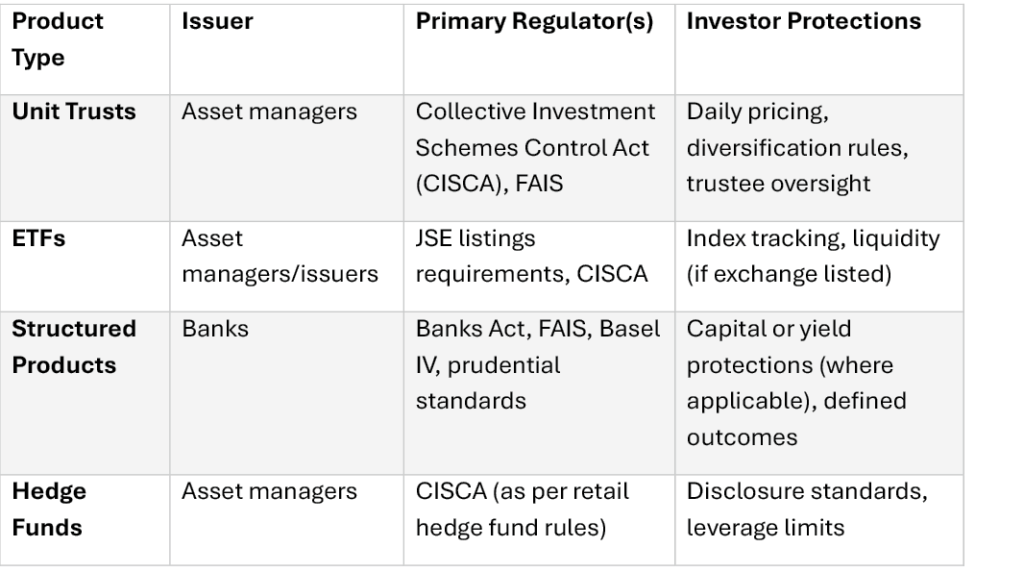

Unit trusts, ETFs, structured products: what’s the difference?

All these products are regulated under South African law, but regulation reduces risk, it does not eliminate it.

Structured products

Structured products are often misunderstood. They offer predefined outcomes based on market scenarios – for investors seeking certainty. Yet, concerns have been raised about their safety. When structured products fail to meet expectations, it’s typically due to:

Misunderstanding the product

- Mismatches between investor needs and product design.

- Mis-selling by advisors or platforms.

Structured products issued by reputable institutions and used correctly perform as expected but require due diligence. Investors must evaluate both the product features and the issuer’s creditworthiness, especially as many products are issued by banks whose obligations are unsecured.

Understanding regulation

In South Africa, investments benefit from multi-layered regulations:

- Statutory laws like CISCA, the Banks Act and the Financial Advisory and Intermediary Services (FAIS) Act.

- Prudential frameworks like Basel IV.

- Conduct regulations enforced by the FSCA.

- Dispute resolution mechanisms.

Beyond formal laws, there are industry codes of conduct, reporting obligations, compliance guidelines and enforcement frameworks, which create a robust safety net.

Investment risks

informed investing begins with understanding.

All investments carry risks that are not unique to any single product type and should be carefully evaluated regardless of the investment wrapper. Key risks include:

- Credit. The possibility that the issuer defaults.

- Market. Losing money due to movements in financial markets.

- Liquidity and marketability. The inability to access/sell your investment without affecting its price.

- Operational and behavioural. Issues like administrative failure or investor panic during volatility.

Clients are increasingly exposed to traditional and alternative investment opportunities, so safety is no longer a one-dimensional concept. It’s shaped by product structure, regulatory strength and investor awareness.

As financial planners, your role is to engage constructively with complex products. For instance, you can translate regulatory frameworks into practical guidance, explain trade-offs across wrappers and align recommendations with client goals. This elevates advice beyond transaction to relationship. When guiding a client on product safety, the message remains the same: informed investing begins with understanding. Understanding begins with engagement. Your ability to engage clients on the safety of their investments is what will ultimately build trust and enhance their investment experience.