Wills are often associated with the end of life because they set out what should happen with our assets and possessions when we pass away. However, have you considered that instead of being the final chapter of a client’s life, a will should be the first part of every financial plan?

A will is an essential part of every financial plan, not an afterthought or a nice to have.

Starting a client’s financial journey with a clear, simple, legally-valid will creates a solid foundation for everything from investments to retirement savings and even business or family planning. So, instead of bolting the drafting of a will onto the end of conversations about financial planning, make it your departure point and use it to create a roadmap for lifelong financial goal setting. For example, if a client has vulnerable dependants, or they want to make sure their children can study one day, it influences how they save and invest, how much life cover they opt for, whether a trust must be set up, etc. Far from being separate from a will, these financial decisions are closely intertwined with it.

This is the approach that Capital Legacy has taken since 2012, leading the charge to raise awareness of the importance of wills, based on the belief that every South African has the right to one. The alternative – dying intestate – can cause huge challenges for those left behind.

It is especially crucial for couples who have a child or children together to draft their wills. So too when bringing children from previous relationships into their new arrangement as is often the case in South Africa’s rainbow nation of family structures – blended, extended and more. A will is the place to nominate preferred guardians for minor children and create testamentary trusts for them.

“Talking about death is such a difficult thing and often avoided so we work hard to help start those conversations and get more South Africans to sort out their wills. A will is an essential part of every financial plan, not an afterthought or a nice to have. Ultimately, it’s about making the loss of a loved one easier,” says Craig Harding, Capital Legacy CEO.

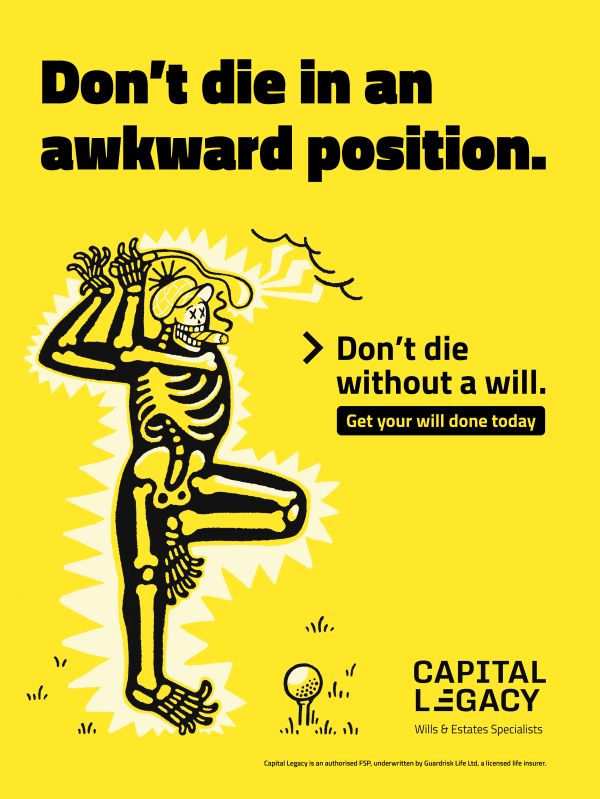

Awkward positions

Capital Legacy has launched a bold new advertising campaign about the importance of having a valid will. It shows a series of awkward positions in which people have died, to convey the message that the most awkward position of all is dying without a will.

“Our campaign is provocative, yes. But it’s intentionally designed to stand out, cut through the clutter and shift behaviour. To get South Africans talking about wills. And more importantly, writing them. To date we’ve helped over one-million South Africans get their affairs in order but there’s more work to be done,” says Grant Fietze, head of marketing at Capital Legacy.

A clear, simple, legally-valid will creates a solid foundation for everything from investments to retirement savings.

One of the biggest barriers to will-drafting that Capital Legacy has identified in conversations with clients is the perception that wills are only for older people and wealthy individuals. Another practical obstacle is good old procrastination. People might intend to get their wills sorted, but they don’t prioritise it… and then it’s suddenly too late. That’s why it’s time to turn this thinking on its head and draft wills for the millions of South Africans who don’t have one.

Every client’s legacy, protected

In 2012, Capital Legacy pioneered a novel type of affordable insurance cover and introduced it to the financial services industry by way of its Legacy Protection Plan™ that takes care of the significant, and often unexpected, costs of dying. When someone passes away, loved ones are left to cover legal and administrative expenses, including executor fees, estate duty and the costs of setting up trusts for beneficiaries. The totals can run into many thousands.

The customisable Legacy Protection Plan™ covers these costs with a combination of affordable insurance and excellent estate administration. It greatly eases the burden on grieving families and ensures a faster, smoother process when finalising a deceased estate. The result is that heirs and beneficiaries don’t have to wait unnecessarily long for their inheritances. Instead of being stuck in administrative and financial limbo, they can move on with their lives.

Anecdotal evidence suggests that deceased estates take a long time to be finalised in South Africa. Durations of two to five years are not unheard of. By employing one of the largest estate administration teams in the country, Capital Legacy regularly wraps up estates in a year or less. They manage this by handling every step of the process themselves. They do not outsource or rely on external executors.

They work closely with a team of dedicated, in-house conveyancers who deal almost exclusively with deceased estate property transfers. This addresses one of the primary reasons why estate administration takes so long in our country and supports heirs and beneficiaries by making sure they do not have to wait unnecessarily for their inheritances.

This is one of many ways in which the loss of a loved one is made a little easier.

Estate Administration

Plenty of companies can help your clients draft their wills, but when they pass away, who will carry out their wishes and make sure their loved ones are taken care of?

There’s a huge difference between ticking off admin items on a to-do list and engaging with empathy at the most difficult time in someone’s life. The Capital Legacy promise is to make the loss of a loved one easier. It does this by providing industry-leading estate administration services that consistently deliver some of the fastest turnaround times in our country.

Instead of bolting the drafting of a will onto the end of conversations about financial planning, make it your departure point.