Have you ever had a client ask you if they are saving enough for retirement? It’s a question to which there are many possible answers. There are many variables that cause this.

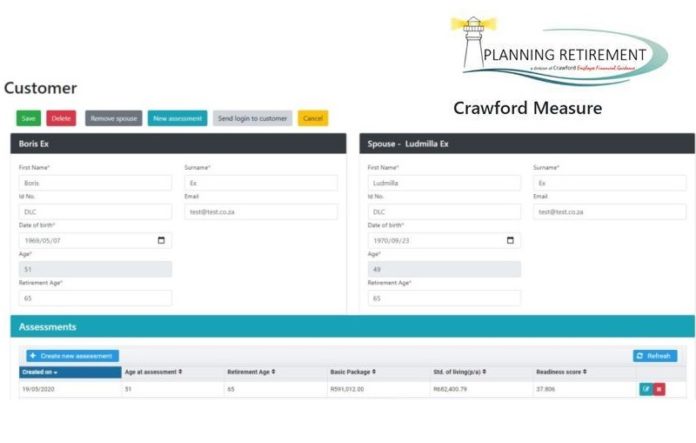

We have built an application to make this question easier to answer, not just once but throughout your clients’ lives until they retire.

Living standard

For starters, how do you define enough? We believe that “enough” in retirement means that they can afford a standard of living in retirement that is the same as, or close to, the one they have now. This means that you need to know what their living standard is now. We define “living standard” as INCOME MINUS SAVINGS MINUS TAX. Whatever is left is what people spend to live on, and thus their living standard.

In theory we could just project this value up to their retirement date and then work out how much capital they would need to provide that at that point in the future.

But it’s difficult because we have no idea what inflation rates will be in the future. It is almost impossible to make those projections with any accuracy at all. If for example we project amounts over 20 years at inflation rates of both 6 and 7 percent per year, we find a difference in the nominal values at the end of the period of 20 percent.

Estimated inflation rates are often used for such calculations, but they can lead to disappointment. We thought we would try something different. We looked at finding a relationship to measure progress. And we found one that works very well indeed.

Retirement Readiness Score: Method

We show the after-tax income the client would have if he/she (or they) retired today, as a percentage of their living standard. This relationship is called their Retirement Readiness Score and it shows us how adequate their retirement provision is now!

We show the after-tax income the client would have if he/she (or they) retired today, as a percentage of their living standard. This relationship is called their Retirement Readiness Score and it shows us how adequate their retirement provision is now!

If a couple’s instant “retirement” income is R15 543 a month and their living standard is R37 995 a month, their Retirement Readiness Score is 40.91 percent. Call it 41 percent. This is a big deal because now we know where they stand. What remains is to help your client figure out how to get that 41 percent score up to 100 percent in the years left until they retire.

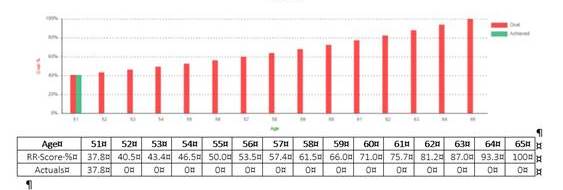

If the elder of the couple is 55 years old, and they both want to retire when he (or she) reaches 65 then they have 10 years in which to raise that score from 41 percent to 100 percent. The app sets out what those scores should be each year for the 10 remaining years to enable annual progress monitoring, to see if they are on track for “enough”. If they are behind, you can offer solutions.

Real returns

A by-product of producing the goals is that the rate by which they must increase annually represents the real return that they need to earn on their capital and ongoing contributions to saving. So, both advisor and client have a series of annual goals to meet and they can tell from the real return needed what the investments must achieve.

Real returns are expressed as total investment returns after deducting the inflation rate and costs. So, if we are given the real return, we can figure out what the overall investment return should be for the years between now and retiring. In this case the real return needed is 9.32 percent per annum. If we add inflation at 6 percent per year and costs of 2 percent per year the overall investment return target needs to be 17.32 percent per year for the next 10 years.

If the annual return they need each year between now and retiring is greater than practically possible, they are not saving enough to reach the goal of having a living standard in retirement that is the same as the one they have now.

As a rule of thumb, we estimate that if the real return is 4.0 percent per year or higher, the client is not saving enough. (A real return of 4 percent plus 2 percent for costs and another 6 percent for inflation means that an overall investment return of 12 percent per annum would be needed.)

The advisor’s job is to improve the situation by providing investment advice that will help these clients reach their goals. You can also tell them to save more, if you believe that the investment return they need is too high to be reached with the status quo.

An amazing thing happens when people save more. Their living standard drops because of the extra saving and their Retirement Readiness Score rises. When a Retirement Readiness Score gets higher it brings the real return that is needed down which in turn lowers the investment returns required to get to the target.

With objective annual goals, reviews become a lot easier to conduct. Using our measure software, you can see from progressive annual assessments whether targets are being met.

When people review their situation every year, they have a very clear sense of their retirement status. This places advisors in a very good position to help clients choose what additional savings they might want to make to get to the target.

Report

The app provides a comprehensive short report. This sums up findings and has two more features.

- The first shows the additional tax-deductible contributions that individuals may make to products like retirement annuities in terms of the regulation limit of 27.5 percent of their remuneration. This is often difficult to calculate because pension funds only allow added percentages of their pensionable salaries, which do not take all sources of income into account. We do apply the top limit of R350 000 per tax year.

- The second is to provide your clients with their personal inflation rate. This is done by comparing one year’s living standard with that of the next. That difference is your client’s personal inflation rate. Inflation is an enormous burden for retired people. When they know what their personal inflation rate is, they can take steps to manage it.

What-ifs

You can test clients’ potential future actions using the what-if facility. If you want to show a client what happens if he increases contributions to saving, you may do so before he commits.

You can also model the effect that working another five years may have on an individual’s retirement adequacy. You can change their goal from the 100 percent that we talk about to say 80 percent and get information on structuring investments for that purpose.

I am sure that anyone who can get his or her clients into the swing of this will have a new basis for the analytics of their relationship.

If you wish to, you can send the client a report directly off the site. This is the only information we provide. You may also provide your client with access to the site so that he or she can look the information up by themselves and use the what-ifs if you are not available.

Unlike life offices and other financial institutions, we are not able to give this technology away, because this is our business. The cost is reasonable, and you can charge it to clients anyway. We are happy to white label the software for advisors.

Pension funds are starting to take an interest in this technology. This means that an advisor who uses our technology will be able to approach members of funds using the technology more easily.

Example of target Retirement Readiness Scores for these clients:

| Age | Target % |

| 55 | 41% |

| 56 | 45% |

| 57 | 49% |

| 58 | 54% |

| 59 | 59% |

| 60 | 64% |

| 61 | 70% |

| 62 | 76% |

| 63 | 84% |

| 64 | 91% |

| 65 | 100% |

Article by D.L. Crawford CFP®, Planning Retirement, dave@planningretirement.co.za