One of the founding principles of Responsible Investment (RI) is the recognition of the interconnected nature of the social, biophysical and market ecosystems. While logical in its construct, the importance of pursuing market returns in a manner that builds long-term ecosystem resilience has historically been trumped by the short-term returns focus of the market and the theory of shareholder primacy.

The Covid-19 pandemic has amplified the sensitivity of the financial system to exogenous shocks and has focused attention on the relevance of unpriced externalities, like climate change, inequality and healthcare, in determining value.

As we seek to “build back better”, it is perhaps an opportune moment for investors to focus attention on the impact their investments have on long-term ecosystem resilience.

This article presents some of the challenges investors face when seeking “Impact” through their listed equity investments and further explores the potential of two impact metrics in the context of benchmarking a general listed equity fund against the FTSE/JSE Capped SWIX All Share Index.

This article presents some of the challenges investors face when seeking “Impact” through their listed equity investments and further explores the potential of two impact metrics in the context of benchmarking a general listed equity fund against the FTSE/JSE Capped SWIX All Share Index.

Seeking impact through the listed markets

Globally, much work is underway to translate our understanding of “impact reporting” for the listed equity markets, where issues such as intentionality, the type of impact, data, investment horizon and benchmarks require further interrogation. However, setting clear guidelines as to defining impact in listed equity still requires more effort and acceptance of standards in reporting.

To illustrate the challenge of reporting on “impact” for a local listed equity portfolio, I explore two crucial impact categories, namely transformation and climate change.

Illustration: Measuring Transformation

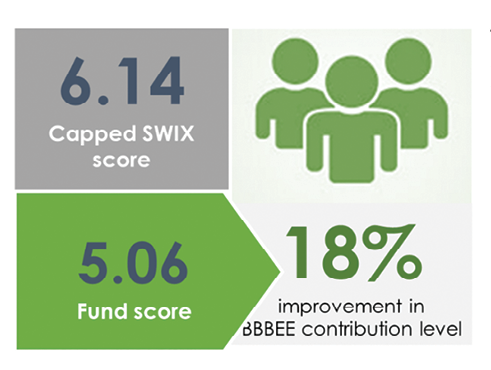

To report on transformation impact, Broad Based Black Economic Empowerment (BBBEE) contribution levels are used as the main measurement metric. The chart below presents the 2019 BBBEE data for a general equity domestic equity fund relative to the FTSE/JSE Capped SWIX All Share Index.

Sector contribution to each of the eight BBBEE contribution levels are graphed along with non-disclosure and non-compliance. The data is presented by market capitalisation, as opposed to by “count”, so as to reflect the contribution larger players make in the areas of skills and supply chain development (60% of the BBBEE score card weight). It could just as easily be argued that the data should be represented by count, in order to reflect the idea that participating in the South African transformation journey should not only be a function of size.

2019 BBBEE Impact Metrics

To further simplify the outcome, we calculated a rolled-up market cap weight score using all levels, including non-disclosure and non-compliance. Lower scores out of 10 indicate a better BBBEE contribution level.

Illustration: Measuring Climate Change

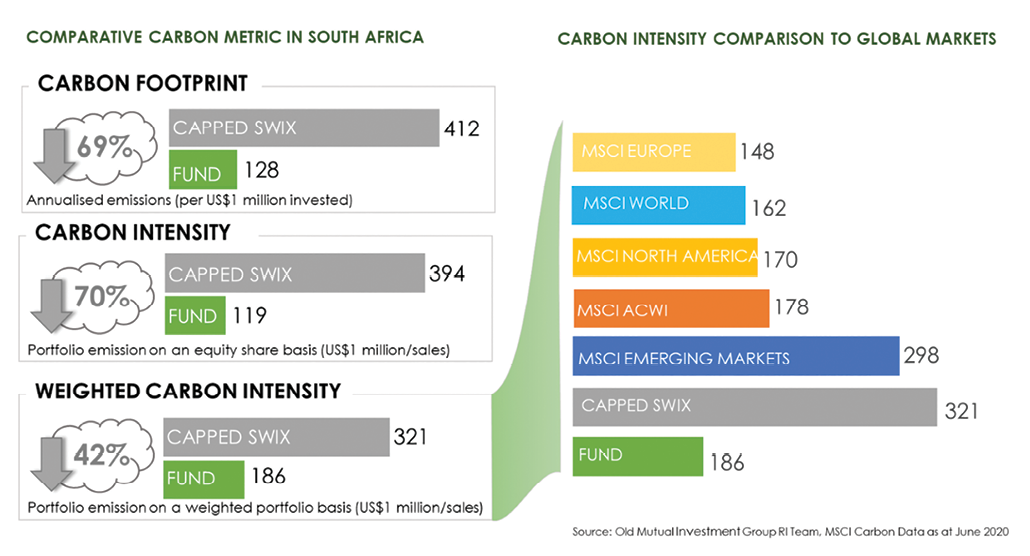

When reporting on climate change impact, I assessed the following carbon metrics to illustrate the fund’s carbon metrics relative to the Capped SWIX. Depending on the metric chosen, the carbon reduction relative to the benchmark could be reported as either 70% or 40%. In both instances, the investor would still not be clear as to whether this reduction was aligned with either national or global ambition.

For the purposes of comparison to other markets, I then reviewed the Weighted Average Carbon Intensity metric against a set of global benchmarks. As can be seen in the chart below, the local benchmark is roughly double the weighted average carbon intensity of the MSCI World benchmark and above that of the MSCI Emerging Markets benchmark, highlighting the highly carbon-intensive nature of our domestic market.

To further complicate matters, the global benchmarks themselves provide no indication as to whether they are aligned with a global 2C ambition, as required by the Paris Agreement on the mitigation of climate change.

Choosing Relevant Impact Metrics

It is important to recognise that both the transformation and climate impact categories have more than one potential metric that could be used for impact reporting. Depending on the specific metric chosen, the narrative related to impact would be slightly varied, thus highlighting the importance of understanding how the metric is calculated and what it evidences.

In both cases, the impact metrics are point-in-time measures that will naturally fluctuate as portfolio weights change. They also provide little insight into the forward-looking practices of the companies held by the fund.

It is important to recognise that both the transformation and climate impact categories have more than one potential metric that could be used for impact reporting.

The investor would need to decide what type of impact they seek: reduction of negative risk and or an enhancement of positive contribution. With both types of impact, calibrating the scale of contribution would require reporting against specific targets and/or benchmarks, and here the debate would need to focus on absolute or relative measures.

For example, defining the transformation impact for a fund, whether absolute or relative, would require in-depth research on underlying components of the BBBEE score in order to align with specific investor goals: Is the investor seeking improvements in ownership and management control, or progress on supply chain and skills development or just a net overall improvement in BBBEE score?

Setting climate impact targets is potentially easier due to the global efforts in this regard. For example, the recently defined “Paris Aligned Climate Targets” as set by the European Union comprise the following key elements: a 50% carbon intensity reduction versus the parent benchmark; it must exclude coal (1% + revenue), oil (10% + revenue) and gas (50% + revenue); and it must decline by 7% per year. While this benchmark is relevant for EU investments, it may not be relevant for the South African market where issues of national policy, energy mix and our “just transition” ambitions would need to be considered.

It is also important for investors to satisfy themselves that their appointed fund manager is intentionally targeting, for instance, specific BBBEE or carbon outcomes. Without this intentionality, the buyer of the fund would have no way of targeting their own impact efforts.

Lastly, from a strategic perspective, listed equity investors need to grapple with the manner in which they would like to achieve impact. Here options include targeting change on a measurable metric over time against target or benchmark, or through the application of hard exclusions or through active stewardship.

Given what is at stake, it no doubt makes good business sense for asset owners, consultants, financial advisors, asset managers, regulators and issuers to work collaboratively on solving for listed equity impact reporting.

Industry Alignment on Impact Outcomes

Given the scale of asset allocation to domestic listed equity markets, it is important that the asset owner community consider how this capital contributes to long-term ecosystem resilience. This requires careful assessment of appropriate impact metrics and long-term impact targets.

Given what is at stake, it no doubt makes good business sense for asset owners, consultants, financial advisors, asset managers, regulators and issuers to work collaboratively on solving for listed equity impact reporting.

Industry alignment on impact outcomes has the potential to create a virtuous circle that connects the RI practices of the investment community with the aspirations of South African savers and the long-term sustainability strategies of listed companies.

Jon Duncan heads up the Responsible Investment team. Their role is to drive the systematic integration of material environmental, social and corporate governance (ESG) issues across the business’ funds under management, including sustainability research and company engagements. He is also involved in regulatory issues and local industry initiatives and was involved in the drafting of the Code for Responsible Investing South Africa (CRISA).