Whether one is selecting a hedge fund for an institutional client or retail client, it is important to recognise that it is a complex process that requires thorough due diligence and a deep understanding of both the client’s needs and the intricacies of hedge fund investing. The factors that should be considered in selecting a hedge fund apply to both the retail and institutional market, although there will be regulatory nuances which a financial planner or an asset consultant and/or retirement fund trustee need to be aware of.

The choice of hedge fund comes after the financial planner or asset consultant/retirement fund trustee has determined that a hedge fund is appropriate for a client’s portfolio. The factors to be considered when making this choice include the following:

Investment strategy and philosophy

- Clarity and consistency: Does the fund have a well-defined and consistently applied investment philosophy and process? In order to understand the extent to which a fund applies its philosophy and process consistently does require a reasonable period of time for it to develop a track record.

- Market focus: What markets, asset classes and techniques does the fund employ? It’s important to note that even if funds invest for example in the same asset class, say equities, there could be significant differences in how managers employ different levels of leverage or different degrees of directional bias – do they tend to be net long, net short or neutral on equity? For example, one manager could have a clear directional bias and be highly leveraged, while another manager may have no directional bias and very little leverage.

- Competitive edge (alpha source): How does the fund generate its returns? What is its unique advantage or “edge”? For example, one fund manager may believe their ability in forensic accounting gives them an edge when shorting equities while another manager may believe their sector-specific experience gives them an advantage in going long only equities.

- Correlation: How correlated are the fund’s returns to traditional markets? Does it offer the desired diversification, not only to the market, but to other hedge funds as well?

Performance and track record

- Absolute and risk-adjusted returns: It’s always important to analyse historical returns, but always in the context of the risks taken. In doing so one can look beyond headline returns to metrics like Sharpe ratio, Sortino ratio and other risk-adjusted performance measures. Importantly, returns and risks taken need to be considered with reference to the manager’s stated philosophy and process. Alignment between what they say they do, and what they actually do is key. It’s all about walking the talk.

- Consistency: How consistently has the fund delivered positive returns?

- Drawdowns: What are the historical maximum drawdowns? How long did it take to recover from them? This is a crucial measure of risk.

- Length of track record: A longer track record generally provides more data for analysis and though past performance is not indicative of future results, it does help determine whether the manager is walking the talk.

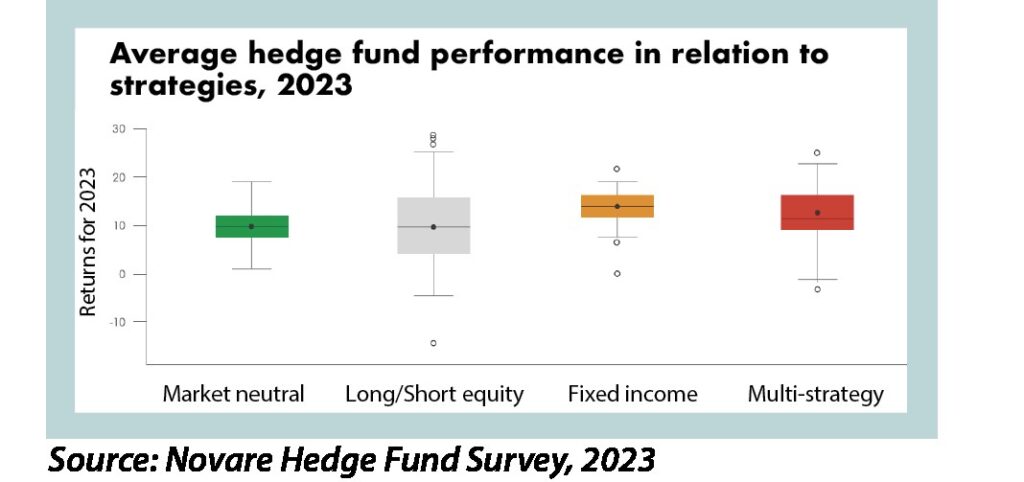

- Dispersion: Hedge funds are not a homogenous investment or asset class. There is a wide dispersion of returns within the hedge fund industry and even within specific strategies, which makes manager selection so important. An indication of the dispersion of returns in the South African hedge fund market can be seen from the performance graphic below taken from the 2023 Novare Hedge Fund Survey. The graphic shows a box and whisker plot illustrating the performance of various hedge fund strategies in South Africa for 2023. Each box represents the range of returns for a specific strategy, with the median indicated by a line inside the box and the average performance denoted by a black dot. Outliers are marked as individual points.

The following insights can be gleaned from the performance graphic about the respective strategies:

Market neutral

With returns clustering between 5% and 15% the performance is stable and tight distribution suggests consistent returns with minimal outliers. The average performance was around 10.5%, which is steady but slightly lower compared to fixed-income and multi-strategies.

Long-short equity

This is the biggest strategy by assets in the SA hedge fund industry with returns extending from just below 0% to almost 30%. This strategy showed a wider range of performance. The median performance was about 8.9%, though there were several outliers on the higher end, indicating that some managers in this strategy can outperform their peers. This approach offers the highest potential for returns, but also comes with higher variability.

Fixed income

The fixed-income strategy returns showed relatively low variability, with returns generally ranging from 5% to 15% and an average return close to 12%. Despite some outliers on both the low and high ends, the majority of funds in this strategy performed within a narrow range, reflecting a more conservative, predictable return profile.

Multi-strategy

As one might expect, multi-strategy funds had a diverse return profile from 0% to over 20%, with the median return at about 10.8%. There are several high-end outliers, indicating that certain multi-strategy funds achieved exceptional results in 2023. This suggests that skilled managers were able to identify opportunities in different asset classes and capitalised on them. The strategy offers a balance between risk and reward by being flexible in allocation from equities to fixed-income instruments.

Risk management

- Robust framework: Does the fund have a sophisticated and robust risk management framework in place?

- Stress testing: How does the fund stress test its portfolio under various market scenarios?

- Leverage: How does the fund use leverage and what is its potential impact on risk and returns?

- Transparency: While hedge funds are typically less transparent than unit trust funds, the investor along with their financial planner or asset consultant should seek sufficient transparency to understand the fund’s exposures and risk profile.

Team and organisation

- Experience and expertise: What is the experience and track record of the investment team, particularly the key decision-makers?

- Key person risk: Is the fund overly reliant on a single individual? What succession plans are in place?

- Operational infrastructure: Does the firm have a robust operational infrastructure, including back-office support, compliance and cybersecurity?

- Culture: How supportive is the fund manager’s business culture of the investment professionals’ ability to deliver on their mandate? How much employee turnover has the business experienced?

- Financial stability: How stable is the business financially? A business that is under financial pressure can be a catalyst for putting pressure on fund managers to generate performance and higher fees, which could lead to greater risk-taking by managers.

Fees and structure

- Fee structure: Understanding the management fees, performance fees and any other expenses is critical so that it is clear what the net return to the investor will be. Comparing these to industry averages is important, as well as being clear on what value is provided.

- Alignment of interests: Are the fees structured in a way that aligns the fund manager’s interests with the clients? The quantum and structure of performance-based fees can be a good indicator.

- Liquidity terms: Less relevant to Retail Investor Hedge Funds, but very relevant to Qualified Investor Hedge Funds as well as institutional clients like retirement funds who may give hedge fund managers a segregated mandate. In these instances, it is important to be clear on potential restraints on liquidity, like lock-up periods or notice periods for withdrawals.

- Minimum investment: More relevant to Qualified Investor Hedge Funds and retirement funds, it is important to be cognisant of minimum investment requirements and whether this suits the investor or not.

Operational due diligence

-

Rob Macdonald, Independent Consultant

Independent oversight: Are there independent administrators, auditors and custodians? - Regulatory compliance: Is the fund compliant with all relevant regulations (eg Regulation 28 of the Pensions Fund Act and/or CISCA)?

- Service providers: Assess the quality and reputation of the fund’s service providers (eg auditors and administrators).

By carefully considering these factors, financial planners and asset consultants can increase the likelihood of selecting hedge funds that align with investors’ financial goals and risk appetites, ultimately contributing to a well-diversified and robust investment portfolio.

But hedge fund selection is not a one-off event, so after investing in a hedge fund, the financial planner or asset consultant must continuously monitor the fund’s performance, risk profile and adherence to its stated strategy. To do this effectively, regular communication with the fund manager is key, to ensure being up to date on market views, portfolio changes and any significant developments.

It is also critical to reassess the hedge fund’s suitability for the investor’s portfolio in light of changing market conditions and economic outlook, as well as the investor’s changing needs.