The ASISA Hedge Fund Classification Standard classifies hedge funds in four tiers. Each tier addresses one of four key questions that any hedge fund investor should consider when deciding to invest:

- What type of investor is the hedge fund for?

- Where geographically does the hedge fund invest?

- What are the different investment strategies that a hedge fund can use?

- What are the different equity strategies that a hedge fund can use?

First tier of classification

The first tier of classification is based on the type of investor.

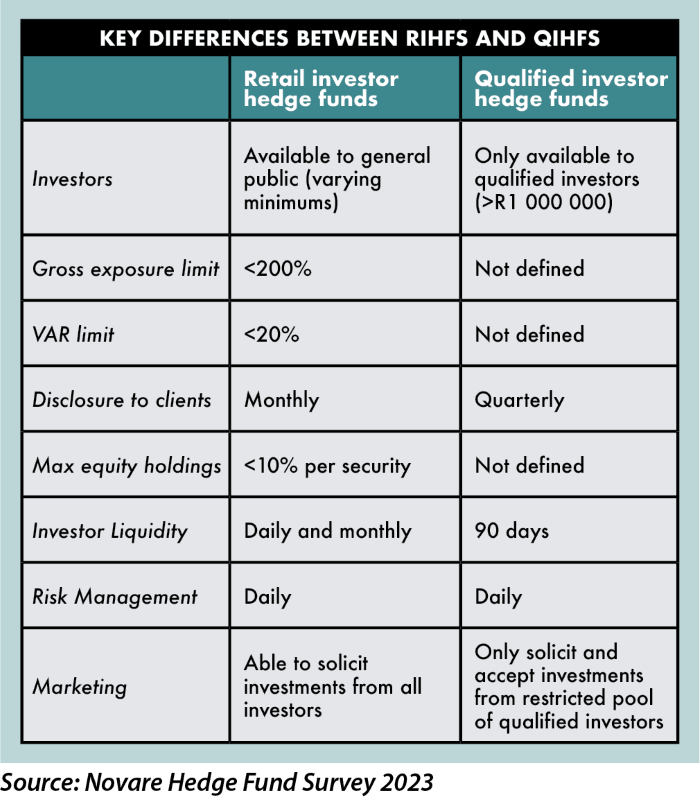

Under CISCA there are two types of regulated hedge funds that are classified according to type of investor:

Retail Investor Hedge Funds (RIHFs) which are aimed primarily at clients who are familiar with investing in long-only traditional unit trusts and are subject to stricter regulatory oversight.

Qualified Investor Hedge Funds (QIHFs) are for “qualified investors” and operated under more flexible regulations than RIHFs. According to FSCA Notice 42 of 2015, a “qualified investor” is a person who invests a minimum of R1-million per hedge fund and who either:

- Has demonstrable knowledge and experience in financial and business matters which would enable the investor to assess the merits and risks of a hedge fund investment, or

- Has appointed an FSP who has demonstrable knowledge and experience to advise the investor regarding the merits and risks of a hedge fund investment.

RIHFs are designed for broader market participation and have stricter investment and risk limitations than QIHFs. The key investment and risk limitations on RIHFs include the following:

Leverage limits

RIHFs have prescribed limits on the amount of leverage they can employ. The gross exposure (sum of all long and short positions) for RIHFs is capped at a maximum gross exposure of 200% of the portfolio’s capital. This means that for every R100 of capital, the fund can have R200 in total long and short positions. This is a significant distinction from QIHFs, where managers have more freedom to set their own maximum leverage levels, which must be disclosed to the regulator and investors.

Position concentration limits

RIHFs have limits on the maximum percentage of the fund’s capital that can be invested in a single equity position, with no net individual equity position exceeding 10% of capital. This helps prevent over-concentration in a single stock and reduces idiosyncratic risk.

Net exposure limits

The gross exposure limit for an RIHF manager of 200% of the fund’s Net Asset Value (NAV) effectively acts as a limit on the net exposure of a fund. The gross exposure is the sum of the absolute value of all long and short positions. For example, if a fund is 150% long and 50% short, its gross exposure is 200%. While this isn’t a direct “net exposure limit”, it effectively caps the amount of leverage an RIHF can take, which in turn limits the potential for extreme net exposures.

Minimum number of positions

To ensure diversification, RIHFs often have a minimum requirement for the number of equity positions they must hold. For example, the FSCA’s requirement of a no more than 10% in a single equity position means that a portfolio is required to hold a minimum of 10 equity positions.

Permitted assets and derivatives

- While RIHFs can use derivatives and engage in physical short selling there are restrictions. Naked short selling (selling a security without being in possession of it or ensuring it can be borrowed) is generally not permitted.

- The use of derivatives is generally for hedging or efficient portfolio management, rather than outright speculative investment that could lead to losses exceeding the portfolio’s Net Asset Value (NAV).

- The types of assets RIHFs can invest in are outlined in Board Notice 90 of 2014 (and its subsequent updates), which determines permitted securities and assets for CIS in securities and retail hedge funds.

Liquidity and repurchases

RIHFs are required to offer daily pricing and daily repurchases. This is a critical risk management feature, ensuring that investors can access their money regularly and that the fund’s liquidity profile matches its redemption terms. This contrasts with QIHFs, which can have less frequent repurchase policies (eg monthly or quarterly).

Risk management frameworks

RIHFs, like all regulated CISs, must have robust risk management functions in place, separate from their investment management and fund administration functions. This includes regular reporting to the FSCA on risk-related matters. A binding valuation policy and independent review of valuations are also mandatory.

Disclosure and reporting

RIHFs are subject to wide-ranging disclosure and reporting requirements to investors, including annual independent external audits and annual reports, providing transparency on their holdings, performance and risk management.

The FSCA’s aim with RIHFs is to strike a balance between allowing the benefits of hedge fund strategies and protecting the general public with explicit limits on leverage and concentration, strict liquidity requirements and comprehensive oversight.

Second tier of classification

The second tier of classification is according to where the fund invests geographically.

South African portfolios – invest at least 60% of their total exposure in South African investment markets. These collective investment portfolios may invest a maximum of 30% of their assets outside of South Africa plus an additional 10% of their assets in Africa excluding South Africa.

Worldwide portfolios – invest in both South African and foreign markets. There are no limits set for either domestic or foreign assets.

Global portfolios – invest at least 80% of their total exposure outside South Africa, with no restriction to assets of a specific geographical country (for example the USA) or geographical region (for example Africa).

Regional portfolios – invest at least 80% of the total exposure in assets in a specific country (for example the USA) or geographical region (for example Africa) outside South Africa.

Note: For the purposes of this second tier of classification, inward-listed equities are deemed to be South African assets.

Third tier of classification

This tier of classification is based on the manager’s self-classification according to the objectives of the investment strategy.

Where a CIS RIHF portfolio or CIS QIHF portfolio has a prior track record and has been classified in a published survey, the category in which they have been published will be considered and any deviation from this will need to be justified by the manager.

Long-short equity hedge funds

These funds predominantly generate their returns from positions in the equity market, regardless of the specific strategy employed. There are probably two key strategies they employ.

First, is a long-short equity strategy, which aims to generate positive returns by taking both long and short positions in the equity market, thereby reducing market risk while retaining company-specific risk. The goal of a long-short equity strategy is to minimise overall market exposure, while profiting from gains in the long positions and price declines in the short positions. Most local equity long-short funds tend to be long biased.

Secondly, the market neutral strategy fund takes similarly sized long and short positions within related equity sectors to offset directional market risk. The goal is to generate profit from both rising and falling prices. This strategy is often achieved by holding matching long and short positions in different stocks, allowing the fund to capitalise on mispricing.

Fixed-income hedge funds

These funds use interest rate sensitivities to generate investment returns by capitalising on arbitrage opportunities in interest rate securities. This strategy uses various techniques such as basis trading (eg cash vs futures), yield-curve arbitrage, credit spread trading and volatility arbitrage in fixed-income markets. The goal is to generate returns while hedging against significant interest rate risk, typically through matched long and short positions in related securities.

Multi-strategy hedge funds

These funds do not rely on a single asset class to generate investment opportunities but rather blend a variety of different strategies and asset classes with no single asset class dominating over time. By combining approaches such as equity long-short, credit arbitrage, macro and statistical arbitrage, the funds aim to achieve diversified, risk-adjusted returns. This flexible approach allows the manager to adapt to different market conditions and capitalise on opportunities across various strategies.

Other hedge funds

These are portfolios that have a very specific strategy that does not fit into any of the other classification groupings. Some of the strategies that may fall into this category include:

- Statistical arbitrage – uses quantitative models and statistical techniques to identify market inefficiencies and establish short-term positions across a broad universe of securities. By analysing historical data, price patterns and correlations, statistical arbitrage seeks to profit from price movements that deviate from historical relationships or expected trends.

- Volatility arbitrage – aims to capitalise on discrepancies between the implied volatility of an option (or other derivative) and the expected, or realised, volatility of the underlying asset. The strategy often takes positions in options or derivatives where the trader believes the market has mispriced future volatility, seeking to profit from volatility-driven price differences, regardless of the directional movement of the underlying assets.

- Commodities – funds that predominantly invest in soft or hard commodities. These funds can follow several different strategies to obtain returns that beat their benchmarks from this asset class, including trend-following or non-directional market-neutral strategies.

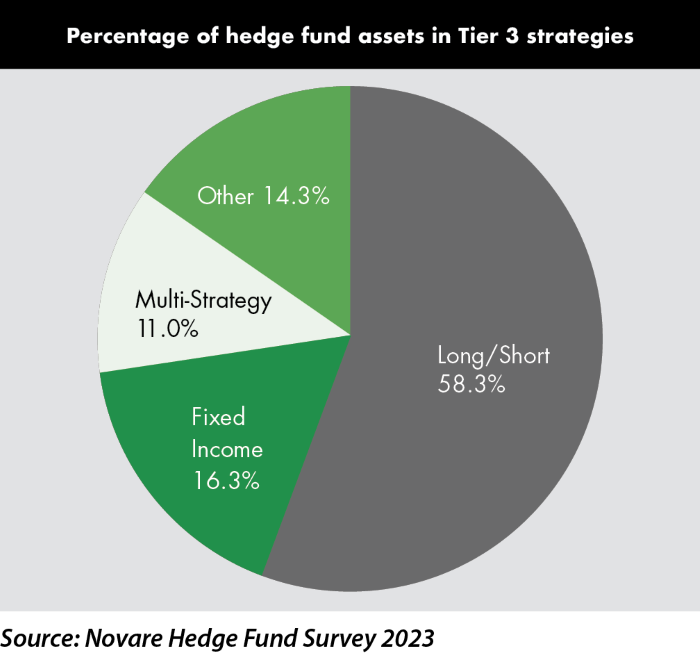

The graphic below indicates the percentage of industry assets in each of the Tier 3 strategies as self-reported by hedge fund managers.

As can be seen, total long-short strategies dominate, with a combined share of 58.3%, showing that the long-short equity strategy is by far the most common strategy employed by hedge fund managers in South Africa. Fixed-income funds represented 16.3% of total industry assets and multi-strategy funds accounted for 11.0% of assets. “Other” strategies represented 14.3% of assets, indicating that a material portion of the industry is allocated to less conventional or niche strategies that do not fall under the traditional classifications.

Fourth tier of classification

The fourth tier of classification applies to those funds classified as long-short equity hedge funds only:

Long bias equity hedge funds: These portfolios are those that over time will have had or aim to have a net equity exposure in excess of 25%.

Market neutral hedge funds: These are portfolios that have had over time or expect to have over time very little directional exposure to the equity market. On average, over time, net equity exposure should be less than 25% but greater than -25%.

Other equity hedge funds: This category is for portfolios that follow a very specific strategy within the equity market such as listed property or sector-specific strategies.

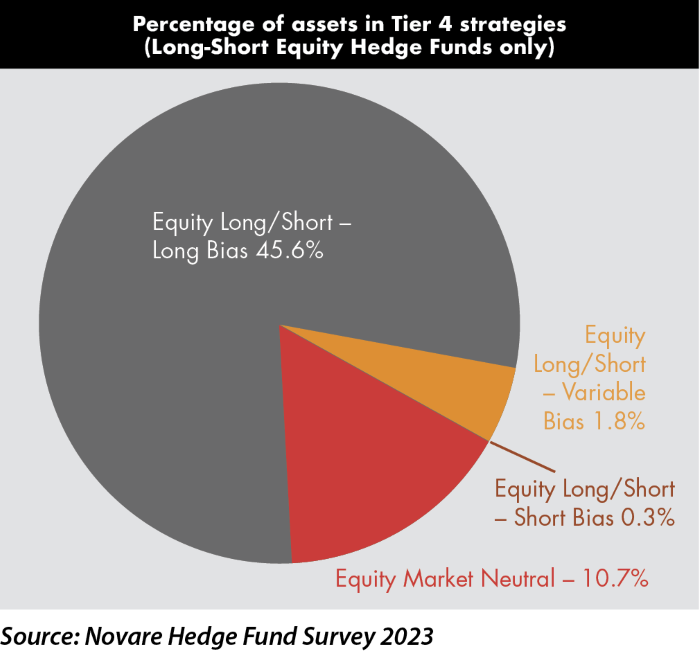

The graphic below indicates the breakdown of the 58.3% of industry assets in long-short equity strategies (see graphic on page 10) as self-reported by hedge fund managers.

As can be seen, the Equity Long/Short – Long Bias holds the largest share of Tier 4 assets, accounting for 45.6%. Equity Long/Short – Variable Bias contributes a small share of 1.8% and Equity Long/Short – Short Bias is negligible at 0.3%, which reflects minimal use of a predominantly short strategy among managers. Equity Market Neutral managers accounted for 10.7% of the industry’s assets invested in

equity long-short strategies.

How funds are managed

Hedge funds can be differentiated not only based on their ASISA classification and the strategy (or strategies) that they follow, but also on how the fund is managed. There are broadly three ways in which a hedge fund in South Africa can be managed:

Single manager funds

These are funds managed by a single investment manager or team and they would usually follow a specific investment strategy.

Multi-managed funds

Multi-managed funds are structured with multiple managers under one fund. The benefit of this is that different strategies can be blended in one fund, enhancing the diversification of the fund. It also means that the investment management business where the fund is housed can exercise greater oversight and control over the different strategies if the managers are all in-house.

Fund of Hedge Funds (FoHFs)

Fund of Hedge Funds invest in a portfolio of different hedge funds, providing the opportunity for different strategies to be blended and diversification benefits to be achieved. The challenge with the Funds of Hedge Funds is that if the funds are managed by independent managers from different hedge fund businesses, the ability to exercise oversight and control over the managers may be limited.