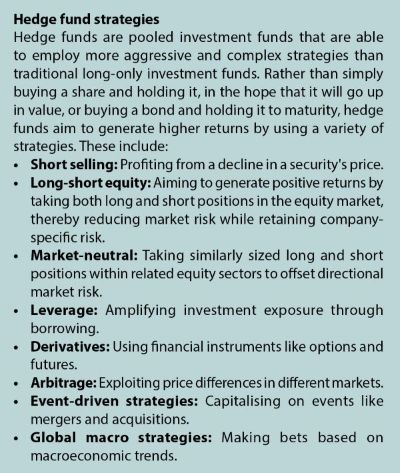

Hedge funds are pooled investment funds employing more aggressive and complex strategies than traditional long-only investment funds. The aim of a hedge fund is to provide investors with above-average returns by actively managing portfolios and implementing strategies that can profit from both rising and falling markets.

A brief history of hedge funds

Alfred Winslow Jones, a former journalist and sociologist, created the first hedge fund structure in 1949 and coined the term “hedged fund”. At the time the term “hedged” was used on Wall Street to describe managing investment risk when there were changes in investment markets. Jones wanted to create a portfolio that could deliver returns regardless of the overall market direction. To do this he used two innovative techniques, firstly by taking long and short positions in shares, and secondly, by using leverage (borrowing money) to buy more shares.

In taking long positions, Jones would buy shares he expected to rise, and simultaneously sell shares he expected to fall (short positions). This “hedged” against market fluctuations, focusing on individual stock picking rather than overall market movements. He bought as many shares as he sold, so market-wide moves up or down would be neutralised in the portfolio. The value of the portfolio, then, would not be based on the direction of the market but whether he had picked the right shares to buy and sell. The use of leverage meant that he could amplify potential returns, but also potentially losses as well.

Jones was also innovative in how he structured the fund and took fees. He avoided having to abide by the requirements of the US Investment Company Act of 1940 by limiting the fund to 99 investors in a limited partnership. Jones’s first investors were reportedly just friends and associates. Initially his fee was 20% of profits which meant there was no fee if he did not make a profit. But this changed when he adopted a 2% management fee on all assets, irrespective of performance.

The elements that Jones introduced in 1949 established the core features of hedge funds: a partnership structure where a percentage of profits is paid as compensation to the general partner/fund manager; a small number of limited partners as investors; a variety of long and short positions; and a fee system of a 2% management fee and a 20% fee on gains often referred to as the “2-and-20” model.

Jones and his structure were not widely known until 1966 when Fortune magazine published an article by Carol Loomis titled “The Jones Nobody Keeps Up With”. The article’s opening line summarises the results at A.W. Jones & Co.: “There are reasons to believe that the best professional money manager of investors’ money these days is a quiet-spoken seldom photographed man named Alfred Winslow Jones.”

According to the article, his hedge fund had outperformed the best mutual fund over the previous five years by 44%, despite its management-incentive fee. On a 10-year basis, Mr Jones’s hedge fund had beaten the top-performing mutual fund, the Dreyfus Fund, by 87%. Initially, hedge funds remained relatively obscure but interest surged in the 1960s after Loomis’s Fortune magazine article highlighted Jones’s significant outperformance compared to traditional mutual funds. This led to the creation of many new hedge funds.

The core proposition of a hedge fund is perhaps captured in Alfred Jones’s long-term track record. Not only had Jones been able to outperform the top mutual funds, but on the downside, investors lost money in only three of his 34 years of managing the fund. In contrast, the S&P 500 had nine down years during that period. Jones had clearly demonstrated that through hedging, a hedge fund can protect investors when markets fall, and through leverage, the hedge fund can magnify returns when markets rise.

In a way the hedge fund industry has mimicked the market since Jones demonstrated the power of this approach to investing. Growth in the industry has not been a smooth ride. In the 1970s there was a downturn due to recessions and market crashes, followed by an upturn in the 1980s as funds grew, markets evolved and more sophisticated strategies were used. The 1990s was a period of significant growth in the number and variety of hedge funds, with more complex strategies being introduced and institutional investors showing greater interest in the sector.

But the 1990s demonstrated that having sophisticated investment strategies was no guarantee of success. Long-Term Capital Management (LTCM) was a hedge fund founded in 1994 by John Meriwether and Nobel Prize winners Myron Scholes and Robert Merton, who were awarded the 1997 Nobel Prize in Economic Sciences for a new method to determine the value of derivatives. This method is known as the Black-Merton-Scholes option pricing formula. The model which they co-developed with Fischer Black is a mathematical equation used to calculate the fair price of financial instruments, particularly options. While Fischer Black was also instrumental in developing the model, he passed away in 1995, making him ineligible for the Nobel Prize. LTCM employed complex mathematical models and high leverage. Despite the pedigree of its founders, LTCM collapsed spectacularly in 1998 due to the Russian financial crisis, and it needed a Federal Reserve-led bailout to prevent wider systemic risk.

Not long after the LTCM collapse, the Tiger Fund, founded by legendary investor Julian Robertson, closed down in 2000 because of significant losses it made due to poor investment decisions in the late 1990s during the dot-com bubble.

During the 2008 Global Financial Crisis, which caused significant disruption in investment markets generally, many hedge funds were forced to restrict withdrawals and experienced significant declines in assets. In fact in the first three quarters of 2008, according to Hedge Fund Research, a Chicago-based data firm, nearly 700 funds, or 7% of the industry shut down.

But despite some high-profile failures of hedge funds, there have also been high-profile successes. George Soros, who founded Soros Fund Management, demonstrated how a hedge fund manager can profit from betting on asset prices falling when he famously “broke the Bank of England” in 1992 by betting against the British pound. He reportedly earned over $1-billion in the process. The Soros fund has a long history of successful global macro investing.

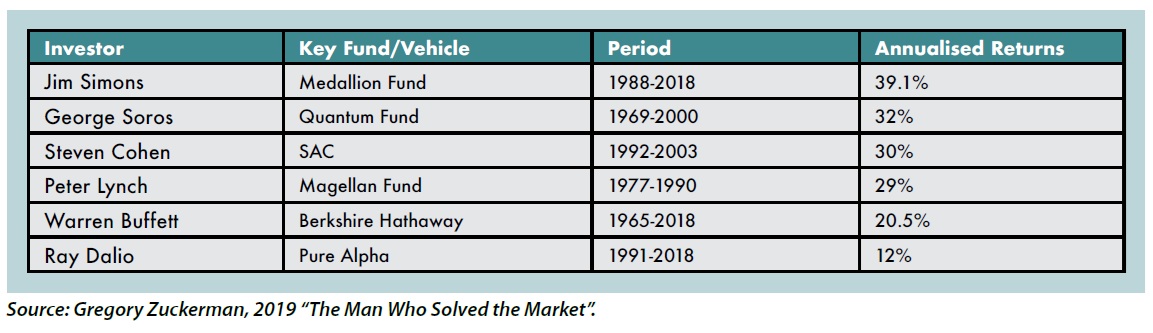

The success of other high-profile hedge fund managers demonstrates that hedge funds offer very effective ways to outperform the market and traditional long-only investors. The one challenge with assessing the performance of hedge funds is the difficulty in accessing performance data if you are not an investor. But an indication of how successful hedge funds can be is provided by Gregory Zuckerman in his book about Jim Simons entitled The Man Who Solved the Market.

Simons was a maths professor who founded the quantitative-based investment business Renaissance Technologies. On the back of much in-depth research, Zuckerman asserts that from 1988 to 2019 (when he wrote the book), Renaissance’s flagship Medallion Hedge Fund achieved an annual return before fees of 66% pa, and an annual return net of fees of 39.1%. His analysis suggests that Simons out-performed all the big-name investors of his generation.

The returns comparison (see table below) is not comparing like with like. Peter Lynch and Warren Buffett’s investment vehicles were not hedge funds, but what it illustrates is the extent to which even after high fees, hedge fund returns have the potential to dwarf the returns of arguably the world’s greatest investor, Warren Buffett.

But it was Warren Buffett who showed that no investment is a sure bet, not even a hedge fund.

In 2007, Warren Buffett took a million-dollar bet with Ted Seides of Protégé Partners that an investment in the S&P 500 Index would outperform Seides’s selection of a portfolio of hedge funds over a 10-year period, net of all fees, costs and expenses. Protégé Partners, as a fund of hedge funds manager, is in the business of selecting hedge funds. The time-frame for the bet was 1 January 2008 to 31 December 2017. Despite this period coinciding with the Global Financial Crisis and the S&P 500 Index returning -38.49% in the first year of the bet, Buffett won the bet convincingly. Buffett invested in a Vanguard S&P 500 Index Fund which achieved a total return of 125.8% for the period, with an average annual return of 7.1%. Seides invested in a portfolio of five hedge funds (the fund names were never disclosed), which provided a total return of 36% with an average annual gain of 2.2% after fees. In reality Seides’s portfolio was exposed to about 100 underlying hedge funds.

The bet started out as a wager for a million dollars to be given to the winner’s charity of choice. Both parties initially put $320 000 each into a zero-coupon bond, which would grow to $1-million at maturity. But in 2012, Buffett and Seides agreed to sell the bond and invest the money in Berkshire Hathaway shares which grew to $2.27-million by the time the bet ended. Buffett’s charity of choice was Girls Inc of Omaha, which runs educational, recreational and mentorship programmes for local youth.

What are the lessons to be learned from this bet? Buffett highlighted that the significant fees charged by hedge funds was a major contributing factor to the underperformance of the portfolio of hedge funds. This may be the case. It could also be that investing in 100 hedge funds is likely to mean that the quality of the hedge funds will range quite significantly. In fact over the past 20 years there has been a rise of so-called “pod shops” where instead of investing in different hedge funds, hedge funds employ specialist teams in their businesses who pursue different strategies under one umbrella. Citadel and Millennium are two of the biggest and best-known hedge funds that employ this approach.

There are hedge funds that have been incredibly successful and that have shown what a powerful investment approach it can be.

The Global Financial Crisis of 2008 also impacted hedge funds significantly, with many having to limit withdrawals to prevent the complete failure of the funds. Buffett has always advised that investors who don’t know anything about investing should put their money into index funds as they are simple and low-cost solutions. Much research shows that active managers (whether hedge fund managers or not) struggle to consistently outperform market indices.

But as we have seen, there are hedge funds that have been incredibly successful and that have shown what a powerful investment approach it can be, when you are looking to make money whatever is happening in the markets. This is unlike traditional long-only fund managers who essentially are betting on asset prices rising in the future, which in a sense is a one-way bet.

Hedge funds in South Africa

The first South African single-manager hedge fund was established in 1998, and five years later, in 2003, the first fund of hedge

funds was set up. Regulation of hedge fund managers began in 2007 when the FSCA required that hedge fund managers hold a Category IIA licence.

In 2011, Regulation 28 of the Pensions Fund Act was amended to enable retirement funds to invest up to 10% of their assets in hedge funds. Previously the regulation had not mentioned hedge funds. This regulatory change was followed in 2014 by the FSCA and National Treasury beginning a process of expanding the scope of regulation and oversight of hedge funds. This resulted in South Africa becoming the first country in the world to implement comprehensive regulation for hedge fund products in 2015. From this point, South African hedge funds have been regulated under the existing Collective Investment Schemes Control Act (CISCA), No. 45 of 2002.

SA Long Short Equity Hedge Funds were most popular with retail and qualified investors in 2024.

Based on regulatory requirements, only certain structures are allowed within the CIS environment, and a portfolio may only use the following structures for the investment of its hedge fund assets:

- A CIS trust arrangement as stipulated by the Collective Investment Schemes Control Act or

- An en commandite partnership (ECP), also known as an LLP or limited liability partnership.

In an ECP, the liability of the en commandite partner (whose name remains undisclosed) towards co-partners is limited to the specified capital amount contributed or committed by the en commandite partner. As a result, the en commandite partner is not at risk of suffering a loss or liability that is greater than their investment or commitment. While most hedge funds have previously utilised ECPs, regulations stipulate that any new structures must be vetted and approved by the FSCA.

According to the Novare 2023 Hedge Fund Survey, the legal structure of hedge funds in South Africa is overwhelmingly dominated by Collective Investment Schemes (CIS), accounting for 99.4% of total assets, which indicates that the majority of hedge funds in the country are structured within regulated investment vehicles. In contrast, limited liability partnerships (LLPs) comprise only 0.5% of assets while other legal structures make up a negligible 0.1% of assets.

The South African hedge fund industry had a record year in 2024 with double-digit net inflows for the first time and reaching its highest-ever level of assets under management.

The South African hedge fund industry had a record year in 2024 with double-digit net inflows for the first time and reaching its highest-ever level of assets under management.

According to the annual hedge fund statistics released by the Association for Savings and Investment South Africa (ASISA), assets under management grew by 34% to R185.12-billion (excluding fund of funds) over the 12 months to the end of December 2024. These assets were invested in 221 hedge funds managed by 12 management companies with hedge fund schemes. With assets of R185-billion, the hedge fund industry makes up just less than 5% of total CIS assets. As at 31 December 2024, there were 103 retail hedge funds in South Africa.

Net inflows in 2024 doubled those from 2023, growing from R6.24-billion to R13.31-billion. The bulk of these flows were from retail investors, and Hayden Reinders, convenor of the ASISA Hedge Funds Standing Committee, says, “This is a strong vote of confidence from retail investors who recognise the important role of regulated hedge funds in mitigating market volatility within an investment portfolio. Our industry is celebrating 10 years of being a regulated investment product in 2025, and it is good to see retail investors increasingly trusting hedge funds as valuable building blocks alongside unit trust funds for a well-diversified investment portfolio.”

Reinders explains that solid investment performance from hedge funds, combined with retail-focused investment manager driven marketing campaigns aimed at demystifying hedge funds and ease of access, have made retail hedge funds an attractive investment choice. South African Retail Hedge Funds attracted net inflows of R11.84-billion in 2024. South African Qualified Investor Hedge Funds, on the other hand, recorded net outflows of R70-million.

The flows into the hedge funds in 2024 varied according to the strategies of the funds. SA Long/Short Equity Hedge Funds were most popular with retail and qualified investors in 2024. SA Retail Long/Short Equity Hedge Funds attracted net inflows of R6.16-billion, while their SA Qualified counterparts attracted R479.01-million. Long/Short Equity Hedge Funds are portfolios that predominantly generate their returns by pairing long positions on equities with short selling to benefit from

both rises and drops in market prices.

SA Multi-Strategy Hedge Funds came in second, attracting retail net inflows of R3.96-billion and qualified money of R7.21-million. Multi-Strategy Hedge Funds are portfolios that do not rely on a single asset class to generate investment opportunities but instead blend various strategies and asset classes with no single asset class dominating over time.

SA Retail Fixed Income Hedge Funds attracted net inflows of R1.72-billion. These portfolios invest in instruments and derivatives sensitive to movements in the interest rate market. Flows into the SA Retail Other Hedge Fund category were flat. These portfolios apply strategies that do not fit into the other classification groupings.

In the qualified investor space, SA Fixed Income Hedge Funds reported net outflows of R535.15-million and SA Other net outflows of R21.92-million.

Reinders hopes the positive trend for retail hedge funds continues in 2025. He also notes that flows into SA Qualified Investor Hedge Funds will likely remain muted until National Treasury finalises its review of the tax treatment of Collective Investment Schemes, including hedge funds. “The review will also provide much-needed tax clarity for our industry, hopefully enabling the Financial Sector Conduct Authority to dust off its review of Board Notice 90. In its current form, BN90 prevents long-only unit trust portfolios from investing in hedge funds even though they are also regulated as Collective Investment Schemes.”

In the US and other jurisdictions, unlike mutual funds, hedge funds typically face less regulatory oversight and are generally only accessible to accredited or sophisticated investors who meet specific income or net worth requirements. They also tend to charge higher fees.

Hedge funds were initially designed as private investment vehicles for wealthy individuals and institutions seeking higher returns and sophisticated investment strategies not available through traditional funds. The exclusivity and higher risk-reward profile catered to those with a greater understanding of complex financial instruments and a higher capacity for potential losses. Hedge funds have also tended to have liquidity restrictions which means that investors aren’t necessarily able to access their funds as easily as they can when invested in a traditional long-only fund.