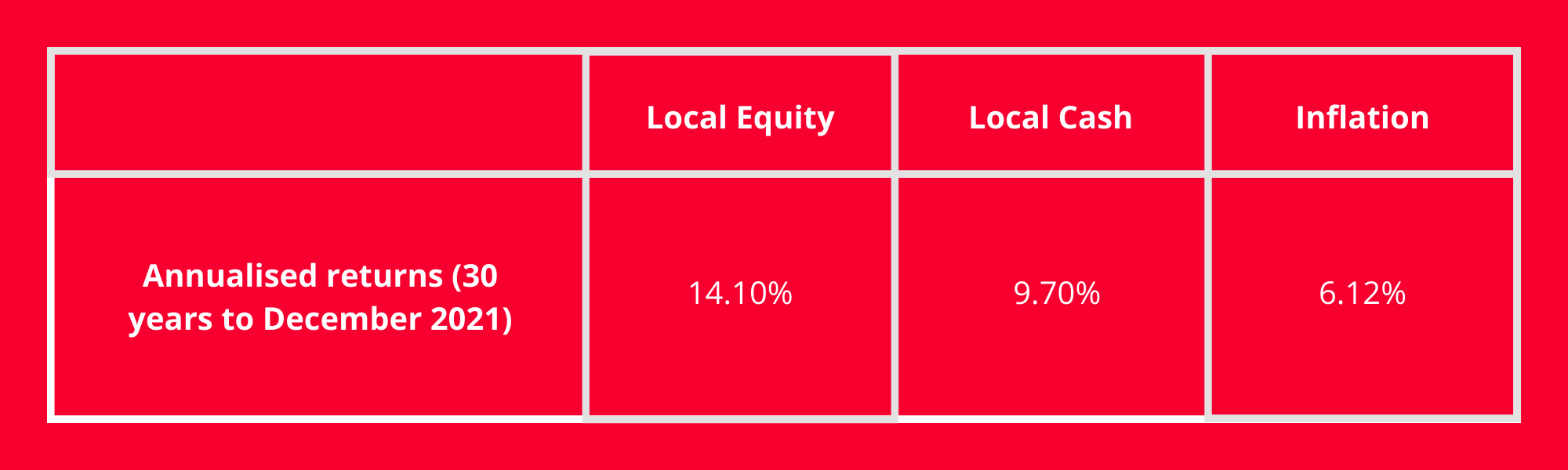

In the middle of a crisis the stress can be so overwhelming that our strong emotions crowd out the rational mind. From behavioural finance we have learned one fundamental truth about investors: we are people, driven by strong emotions. We therefore often do exactly the opposite of what would be in our long-term financial interest. The fear of losing money is often at the heart of ill-informed financial decisions. If we look at the long-term experience of equities, cash and inflation (table 1), we clearly see that the “right” decision was to rather invest in equities as opposed to cash.

Table 1: 30-year returns (annualised) up to 31 December 2021 in South African markets

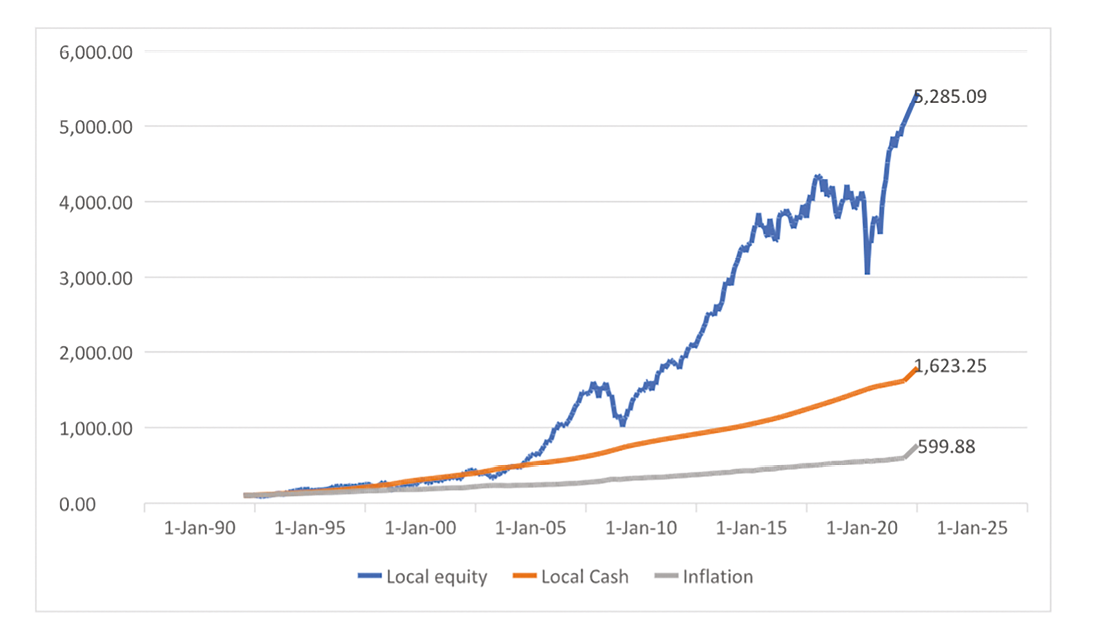

Chart 1 repeats this view, showing the cumulative value of R100 invested over a 30-year period. What it demonstrates is the rollercoaster that an investor would have experienced over that time. The global financial crisis of 2008 and the Covid-19 crash of 2020 clearly show how difficult it would be to have been invested over these periods. Cash gives a comparatively comfortable ride, albeit one where you forfeited most of the potential return from equities. This is an opportunity cost – you may not lose money, but you ended up in a significantly worse financial position than what you could have had, had you been able to navigate and remain invested in the more volatile equity market.

Chart 1: Cumulative return of R100 invested for 30 years to 31 December 2021

Stating that investing in equities over the longer term, and reasonably into the future, is the right investment decision rather treats investors as purely rational decision-makers. What this approach does not consider is that investing is personal – individual investors may have differing time horizons and capacity to take risk and, often in prolonged down markets, may eventually run out of stamina to hear more bad news.

My own experience with financial planning and investments is that it is far more useful to make decisions in advance, aligned to a clearly defined investment plan.

The benefit of planning is that you will have the opportunity to think through a range of different outcomes (good and bad) and how you are likely to feel and want to react under these circumstances. An investment plan provides a framework for a greater level of clear thinking when things do go off course. The chance of poor decision-making under emotional distress is also mitigated.

A financial advisor plays a critical role as part of this process. Not only will you have the tools to help clients with the planning process, but in times of distress also act as a sounding board to help clients think through what actions they should take under differing circumstances.

However, in general, the best course of action, once you have a clear plan and investments that are well-aligned to that plan in terms of time horizon, level of diversification and risk, is to do nothing. Storms in financial markets eventually abate, generally this time is not really that different and most often the right course of action is to remain invested.

At Momentum Investments we have taken this to heart in our outcome-based investing philosophy where we create portfolios that are calibrated to different timeframes and levels of risk, all with a sound base of diversification. Because with us, investing is personal.

Momentum Investments is part of Momentum Metropolitan Life Limited, an authorised financial services and registered credit provider (FSP 6406).The information in this article is for general information purposes and not intended to be an invitation to invest, professional advice or financial services under the Financial Advisory and Intermediary Services Act, 2002. Momentum Investments does not make any express or implied warranty about the accuracy of the information herein. Past performance is not indicative of future performance.