A leap forward into a new digital era

Momentum Wealth International's redesigned website ushers in a new era in how financial advisors, wealth managers and clients in South Africa and beyond interact with digital platforms that facilitate offshore investing.

Start investing through a tax-free investment, asap

Using tax-free investments, also known as tax-free savings accounts, and starting as soon as possible, can have meaningful benefits for wealth-building, writes Pierre Jean Marais, retail marketing at Momentum Wealth.

A universal perspective

Ferdi van Heerden took over the reins at Momentum Investments in September 2023. He has filled a range of executive positions in the Group, culminating in more than a decade of leadership in the international investment industry as head of Momentum Global Investment Management in the UK. Blue Chip caught up with him.

Investing in machine learning research

Machine learning is a rapidly growing field that offers many potential applications in investment management and related fields, writes Eugene Botha, Deputy Chief Investment Officer at Momentum Investments.

Demystifying Smart Beta

According to Ali Simpkins, the Fund specialist at Momentum Investments, Smart Beta has disrupted the binary choice between active and passive investing.

Investors lose millions due to their switching behaviour

Past performance is not a good indication of future returns, but it remains one of the main determinants of ‘behaviour tax’, writes Paul Nixon, head of behavioural finance at Momentum Investments.

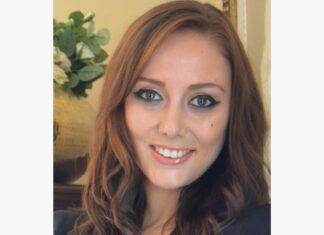

Momentum Investments’ new CEO: Ferdi van Heerden

Ferdi van Heerden took over the reins at Momentum Investments on 1 September 2023.

Give clients more control through certainty

In this environment of high interest rates, clients can lock in very attractive guaranteed annuity rates, says Fareeya Adam, head of guaranteed annuities at Momentum Wealth.

Taking the logical next step – invest your savings money

During these unpredictable times, it is now more vital than ever for people to take the first step in changing their spending habits, and the next step to investing their money smartly, says Pierre Jean Marais, Retail Marketing, Momentum Investments

How the Momentum Income Plus Fund can provide a haven in...

The Momentum Income Plus Fund has a unique value proposition: a high level of income and access to a diversified range of companies, says Karabo Seima, Portfolio Manager at Momentum Investments.

Most Popular

What key factors should institutional investors consider?

The role of structured products in institutional investments is growing, but these investors need to consider all the usual risks and benefits including liquidity and compliance with regulations such as Regulation 28 of the Pension Funds Act.

What risks and potential rewards need to be evaluated in structured products?

In evaluating structured products, all the risk factors need to be balanced against the benefits to ensure that the risks don’t undermine the benefits.

The transparency of structured products’ risk-return profiles and fees

When recommending structured products, advisors need to ensure risk and return profiles are suitable for investors. Full disclosure also requires transparency about the costs of investing. But risk-return profiles in structured products sometimes depend on the interplay of guarantees, conditions and pay-offs. Embedded costs are difficult to evaluate but listed products should be disclosing these.

Alexforbes named South African Manager of the Year at the Raging Bull Awards

Alexforbes were honoured at the Raging Bull Awards with two prestigious awards that highlighted the firms investment achievements and long-term performance.

What are the different types of structured products available to retail and institutional investors...

There is a limited range of structured products offered in South Africa compared to the rest of the world.