Consider paying off debt prior to retirement

Coming to the end of your working career requires a step up in terms of financial planning, says Florbela Yates, Head of Equilibrium.

Give clients more control through certainty

In this environment of high interest rates, clients can lock in very attractive guaranteed annuity rates, says Fareeya Adam, head of guaranteed annuities at Momentum Wealth.

The 7 Pillars of Financial Health – Partnering with a Professional...

Blue Chip interviews the author of The 7 Pillars of Financial Health, Rob Macdonald.

Emerging Markets: a coming bull market?

After thirteen years of underperformance versus high-flying US markets, investors have forgotten what an EM bull market looks like. A closer look at history and where markets are today suggests we may be closer than many think or are positioned for, argues James Corkin, Portfolio Manager at Steyn Capital Management

The power of professional financial planning

CFP® professionals benefit their clients holistically in ways beyond growing their wealth. Clients realise this, as shown in the FPI and Financial Planning Standards Board’s Value of Financial Planning Research 2023 study.

Empower tomorrow’s graduates today

Farzana Botha, Segment Marketing Manager at Sanlam Risk & Savings, says the Graduate Student Package helps intermediaries expand their client base by addressing the graduate market’s specific requirements, including protecting their greatest asset – their future ability to earn an income – while studying.

Taking the logical next step – invest your savings money

During these unpredictable times, it is now more vital than ever for people to take the first step in changing their spending habits, and the next step to investing their money smartly, says Pierre Jean Marais, Retail Marketing, Momentum Investments

The hype around investing offshore is back at the euphoric levels...

Offshore investing trends in the mid-1990s differed hugely from today. Fund choices open for South Africans extended to no more than five options, yet almost every application form received, allocated the funds, whether on a recuring premium basis or as a lump sum, to asset swap/feeder funds, says Sheldon Holdsworth, Old Mutual International, Regional Offshore Specialist.

Retirement coaching: adding value to your practice

When the prospect of full-time retirement looms, your clients will suddenly have many hours of free time to do all those things that they dreamed of during their working life., says Stephan le Roux, CFP®, Financial Planning Coach, Old Mutual Wealth

Most Popular

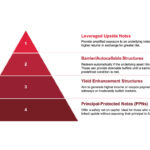

Absa Index and Structured Solutions philosophy and process

Absa Index and Structured Solutions (AISS) offer a broad range of structured products with bespoke solutions offering a client-centric focus designed to match clients' unique preferences, risk profiles and financial goals.

Index methodologies in structured products

This piece aims to provide an understanding of how issuers select and

build indices for structured products, writes Fundiswa Pikashe, Head of Structured Products Distribution at Absa.

VISION 2030

Blue Chip speaks to the Financial Planning Institute of Southern Africa’s CEO, Lelané Bezuidenhout, about winning the FPSB 2025 Noel Maye Award for outstanding contributions to the profession as well as the FPI’s new Vision 2030 strategy.

Enter adviser practice buy-and-sell conversations with confidence

Blue Chip speaks to Brokerspace and Commspace to find out why understanding the full picture before choosing a path forward might change your succession and sale conversations for the better.

Why blending unit trusts remains essential

In an environment where opportunity and uncertainty coexist, blending unit trusts is not about being cautious. It is about being prepared. By Natalie Harrison, Head of Distribution at Curate Investments.