Hedge funds in South Africa remain an industry plagued by misconceptions. A lot of the blame for this can be placed on the US hedge fund industry, and the industry’s portrayal as a lawless frontier in Hollywood. While the US remains a dominant global player, accounting for approximately three-quarters of global hedge fund assets under management, it’s essential to recognise the stark difference between the US and South African industries.

- The US industry remains largely unregulated: The US hedge funds industry operates with minimal regulatory constraints. A key example is that US hedge funds are generally not required to audit their accounts.

- The US industry employs significantly more leverage: A recent Federal Reserve report estimated the balance sheet leverage ratio (gross asset value to net asset value) of the 50 biggest qualifying hedge funds in the country at almost 7-to-1 As a contrast, South African retail hedge funds are limited to 2-to-1.

- US hedge funds employ many opaque and intricate strategies, whereas the SA industry predominantly favours simplicity, with long/short equity strategies making up around 60% of the market.

In 2015, South Africa became the first country in the world to implement comprehensive regulation for hedge funds. The changes brought about by this regulation have helped to further distance the industry from that of the US, a fact that has yet to be fully appreciated by investors.

While the greater certainty of regulated hedge funds has translated into increased retail inflows into hedge funds, we have not yet seen pension funds invest into hedge funds to the same extent. This is even more surprising when considering that the Regulation 28 allowance was effectively increased from January 2023 to allow pension funds to invest up to 10% of their assets into hedge funds.

According to a 2020 Mercer study of Europe’s largest pension funds, which covered assets of €1.1 trillion, 38% of these funds have an allocation to hedge funds, with the average size of allocations varying between 5% and 20% of fund assets. Our own analysis of the largest 200 pension funds in South Africa suggests that less than one in 20 local funds have allocations to hedge funds, with these allocations on average being far below the regulatory allowance of 10% of plan assets.

Our view is that under-allocated South African investors are missing out, given:

- the strong returns that select hedge funds have delivered, including the opportunity for alpha generation on the short side,

- the potential for downside protection in market drawdowns,

- the relatively low correlation to local equity indices, and

- the fact that hedge funds are now regulated by the FSCA, reducing risk for investors.

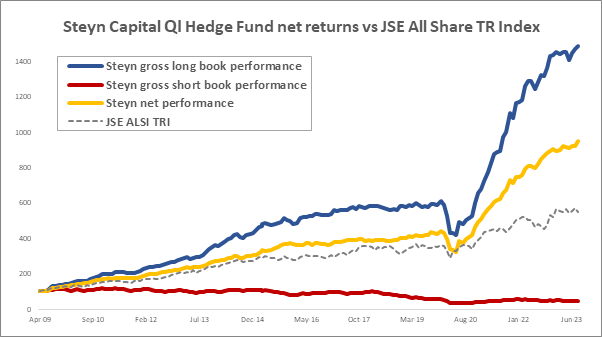

The graph below sets out the return streams of our longest-running hedge fund’s long book (blue line), which has outperformed the market by close to eight percentage points per annum over 14 years, and our short book (red line), which has outperformed the inverse of the market by 16 percentage points a year over the same timeframe. Short selling can be regarded as a type of market insurance, and it is particularly pleasing when your insurance is paying you each year, as our short book has done by generating a meaningful positive return. The combined performance has allowed our qualified investor hedge fund to significantly outperform the stock market over the period while taking on approximately a quarter of the market’s risk.

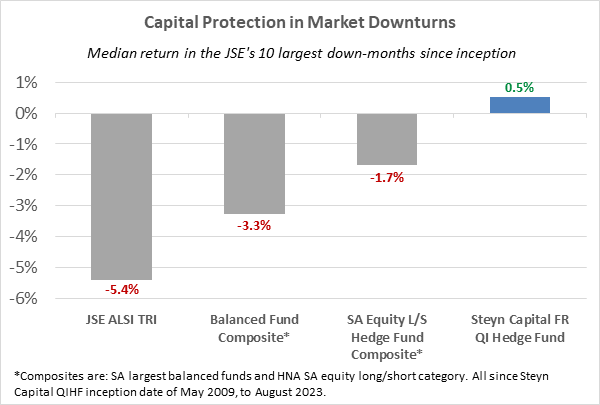

The potential downside protection offered by hedge funds is best illustrated by the following graph, which shows our hedge fund’s performance after fees during the 10 most significant monthly market declines over the past 14 years. Our hedge fund has not participated in the majority of the drawdowns, achieving a median positive return of 0.5% versus the market’s median 5.4% decline. A composite of South African long/short equity hedge funds also demonstrates robust downside protection in market drawdowns, with a median 1.7% decline. It is noteworthy that the typical balanced fund, represented here through a composite of South Africa’s largest balanced funds, has offered less protection than hedge funds over the period, with a median 3.3% decline.

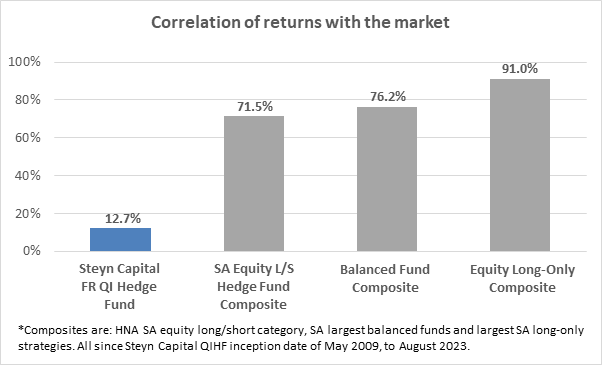

Beyond mitigating downside risks, hedge funds also offer an excellent opportunity for diversification, a concept Nobel prize laureate Harry Markowitz famously dubbed the “only free lunch in investing”. The following chart takes a look at the correlation of monthly returns against the JSE All Share index. Not surprisingly, the average long-only unit trust has a very strong correlation to the index, at 91%. The typical balanced fund carries a lower, but still surprisingly high 76% correlation. The lowest correlations are achieved by hedge funds, with a composite of SA long/short equity hedge funds at 72%, and our hedge fund at a strikingly low 12.7% correlation.

In conclusion, the persistent misconceptions surrounding hedge funds in South Africa are understandable when viewed in a global context, considering the misuse of these structures in less regulated jurisdictions. In South Africa, however, the evidence speaks for itself: hedge funds offer a valuable addition to portfolios. Their ability to mitigate downside risks, reduce correlation to the market, and outperform equity markets over time, underscores their potential for significantly enhancing an investment portfolio.