A shift up and to the left

By understanding their unique strategies and regulated nature, investors can leverage the true potential of hedge funds to achieve higher returns while effectively managing risk, writes Francois Olivier CA(SA), CFA, Portfolio Manager,

Mazi Asset Management and Stephan Engelbrecht, Portfolio Manager,

Mazi Asset Management.

Impact and returns: why financial planners should consider ACOF

Financial planners are often faced with a key challenge when advising clients: balancing the desire for strong financial returns with the growing demand for investments that drive positive social and economic impact, writes Warren Wheatley, CEO of Altvest Capital.

Survival of the fastest

With the arrival of Artificial Intelligence into the mainstream world, we find ourselves at a point of optimism over the future in this cycle of technology innovation, writes Doug Nicol, Investment Analyst at Fundhouse.

Creating procedures with ChatGPT

Francois du Toit, PROpulsion, shares his guide to creating SOPs using ChatGPT.

Knowing isn’t doing

Henda Kleingeld, UFS Program Director, discusses why smart financial advisors should have their own trusted financial advisor.

Looking forward to a RAG-based future

Professor Evan Gilbert and Paul Nixon, Momentum Investments, provide answers to why AI is going to be a part of the future of financial advice.

A Coaching Way of Being

Blue Chip explores the role of coaching in unlocking financial potential. Behavioural coaching expert, Rob Macdonald, unpacks what it is and why it is important to the work of a financial planner.

Client confidence beyond the wrapper: engaging investors on investment safety

According to Vuyo Nogantshi, Head

of Distribution: Index and Structured Solutions, Absa Group, financial planners need to demystify an increasingly complex array of products in today’s investment landscape.

Three AI tricks to make your clients love you more

Using AI cleverly can drastically reduce your workload and extend your reach, writes Zeldeen Müller, CEO, AgendaWorx.

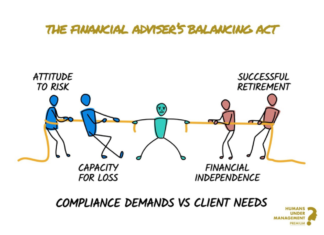

Choose your poison

According to Any Hart, Founder of Humans Under Management, financial advisors must champion their clients’ futures, confronting misguided compliance systems that obscure the real risks – capital loss, inflation, and poor returns – while working towards a framework that truly safeguards financial well-being.

Most Popular

How flexible and customisable should a DFM offering be?

As DFMs grow in scale and influence, the debate around flexibility and customisation in their investment offerings intensifies.

Meet the Managers 2026

Meet the Managers is considered the “Ted-Talk” in investment management, where financial advisors can access a vast array of investment managers, covering all types...

Offshore investment gains momentum in SA

Blue Chip speaks to Hymne Landman, CEO at Momentum Wealth, about offshore investing for South Africans.

VISION 2030

Blue Chip speaks to the Financial Planning Institute of Southern Africa’s CEO, Lelané Bezuidenhout, about winning the FPSB 2025 Noel Maye Award for outstanding contributions to the profession as well as the FPI’s new Vision 2030 strategy.

Protecting independent financial advice

The Financial Intermediaries Association of South Africa’s primary purpose is to guard, develop, promote and represent professional advisory and intermediary businesses in the financial services industry. Blue Chip speaks to Lizelle van der Merwe, CEO of the FIA.