Behavioural biases: unravelling our irrational investment habits

Amid market volatility, currency fluctuations and a climate of uncertainty surrounding South Africa’s growth prospects, it becomes increasingly important to explore the common biases that can significantly impact financial decision-making.

Milpark School of Financial Services introduces unprecedented qualification

Milpark Education is the first of its kind in the country to offer industry specific streams. A Postgraduate Diploma in Risk Management has been added to the School of Financial Services courses.

Making ESG work for the agricultural sector

Agribusinesses can maximise opportunities and promote resilience by adopting ESG strategies, according to Lerato Molefi, Associate, and Dalit Anstey, Knowledge Lawyer, from Webber Wentzel.

Disruption, reinvention and inclusive leadership: how can we use the opportunity...

Judith Haupt, Managing Director at Contract South Africa, states that the business environment is being reshaped due to social trends. It is important that we realise that these trends pose both big risks and opportunities to rethink our work and our world fundamentally.

Limiting medical aid increases isn’t the answer

Gary Feldman states that private healthcare systems are not sustainable in its current format. Feldman calls for a review of both the private and public healthcare systems in order to come up with a system that allows all South African access to affordable and decent healthcare.

Intelligence: the emotional and the artificial

Emotional intelligence gives us the edge that will allow us to coexist and not resist artificial intelligence.

The art of estate planning

The role of a multi-family office in preserving wealth and protecting family legacies.

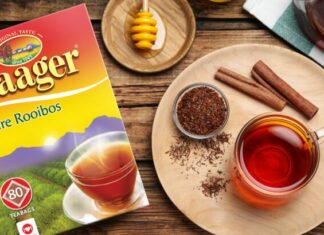

The status of Rooibos is internationally protected

The popular tea that is really a herb has a number of surprising qualities. Rooibos specialist Joekels shares 13 fast facts about South Africa’s beloved brew.

Technology and the customer experience

Francois du Toit, the CFP and founder of PROpulsion provides advice to financial advisors and planners who want to keep up with the significant transformation of the financial planning industry.

Most Popular

VISION 2030

Blue Chip speaks to the Financial Planning Institute of Southern Africa’s CEO, Lelané Bezuidenhout, about winning the FPSB 2025 Noel Maye Award for outstanding contributions to the profession as well as the FPI’s new Vision 2030 strategy.

Satrix celebrates 25 years of industry leadership

The Satrix story began in January 2000 with a first institutional mandate of R800-million, at a time when passive investing was still largely uncharted territory.

Meet the FPI Financial Planner of the Year

Established in 2000, the FPI Financial Planner of the Year Award is highly coveted and recognises outstanding achievement in the field and practice of financial planning. In 2025, the award went to Nicola Langridge, CFP®, wealth manager at Private Client Holdings. Blue Chip caught up with her.

Investment platforms: powering advice, enabling better client outcomes

Hymne Landman, CEO at Momentum Wealth, discusses the importance of the human element in providing clients with the best financial advice and planning.

Anatomy of an ‘almost’ bubble

What impact could big tech and AI have on the investment landscape and what is the potential for a market bubble to have a major effect on affect investment portfolios?