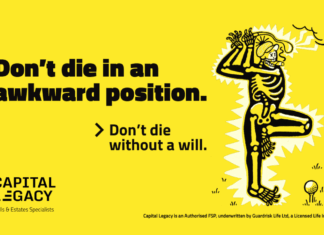

Don’t die in an awkward position

Capital Legacy stresses the importance of South Africans having a will regardless of age through their latest awareness campaign: "Don't die in an awkward position. Don't die without a will.".

The hidden complexities of trust beneficial ownership compliance

According to Sandile Khumalo,LLM (Unisa),

FPSA®, GTP(SA), Fiduciary

Practitioner, Lex24, financial advisors frequently recommend the use of trusts as an estate planning tool and in some instances, they serve as the professional trustee on client trusts.

Can I afford to die? And other questions you need to...

Marnus Mostert, Franchise Principal and Certified Financial Planner CFP® at Consult by Momentum, challenges South Africans to think carefully about the question: Can I afford to die?

The status of electronic wills in South African law: still hanging

Even though there is no specific law governing electronic wills, people are still creating them, so the law should address this development seriously, writes Dr James Faber, Senior Lecturer, Department of Private Law, University of the Free State and Admitted Attorney, High Court South Africa.

What does the Two-Pot System mean for my legacy

September marked the introduction of the two-pot system of access to retirement savings for South Africans. Capital Legacy National Manager of Succession Planning and High Advice, Ken Newport, explains how Two Pot will – and won’t – impact your legacy.

The most important signature of all

Capital Legacy knows that you will sign many important documents in your life, but none more significant than your last will and testament. Here’s why that is the most important signature of all.

Who do you trust with your digital information?

Who do you trust to access your digital information, if something happens to you? A question posed by Sarah Love, CFP®, FPSA®, TEP, Fiduciary Practitioner at Private Client Trust.

The art of estate planning

The role of a multi-family office in preserving wealth and protecting family legacies.

How to use financial products to enhance estate planning

An estate consists of the assets and liabilities that an individual accumulates during their lifetime and leaves behind at death. An individual should create and manage an estate plan to preserve, grow and protect their assets during their lifetime and ensure that those assets are transferred to successive generations, says Felicia Hlophe, Legal Advisor, Allan Gray

The rise of family offices in South Africa

Many high-net-worth individuals (HNWIs) are increasingly looking to the family office model to protect and manage their wealth in a more cohesive manner says, Grant Alexander, Director, Private Client Holdings.

Most Popular

Causeway Securities

Founded in 2016, Causeway Securities is a global independent securities brokerage headquartered in Belfast, with offices in London and New York.

IRFA 2026 Conference

The IRFA 2026 Conference will address the dual transformation facing African retirement funds: navigating a fundamentally changed global order while meeting dramatically evolved member expectations.

How flexible and customisable should a DFM offering be?

As DFMs grow in scale and influence, the debate around flexibility and customisation in their investment offerings intensifies.

Meet the Managers 2026

Meet the Managers is considered the “Ted-Talk” in investment management, where financial advisors can access a vast array of investment managers, covering all types...

Offshore investment gains momentum in SA

Blue Chip speaks to Hymne Landman, CEO at Momentum Wealth, about offshore investing for South Africans.