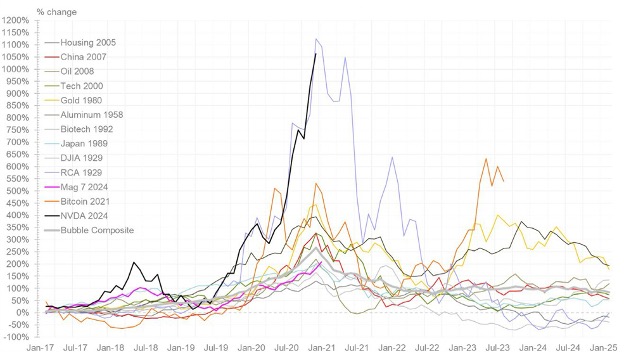

Bubbles are a commonly referenced phenomenon in today’s financial markets; however, the term has been around since the early 18th century. Speculative bubbles have occurred in a wide range of assets over time as can be seen in Figure 1. Although they tend to result from a combination of investor speculation and herding behaviour, accurately defining bubbles and identifying where they may occur is difficult. In fact, the only certainty is that speculative bubbles tend to increase the price of an asset higher and for longer than most people assume. In addition, we can only be certain that bubbles exist once they have burst.

We can look back at history and easily pick out well-known bubbles like “Tulip Mania” or the “Dot-Com Bubble”, but it is significantly more difficult to consider markets today and ask yourself “is this a bubble?” This question is only clear in hindsight as the causes of bubbles tend to differ in each instance. In this article we ask the question: are we in an AI bubble? While each bubble differs, all bubbles have common characteristics, so we will assess the AI bubble using an established framework that defines the key components of all speculative bubbles.

Figure 1: The price of select bubbles over time relative to Nvidia in 2024

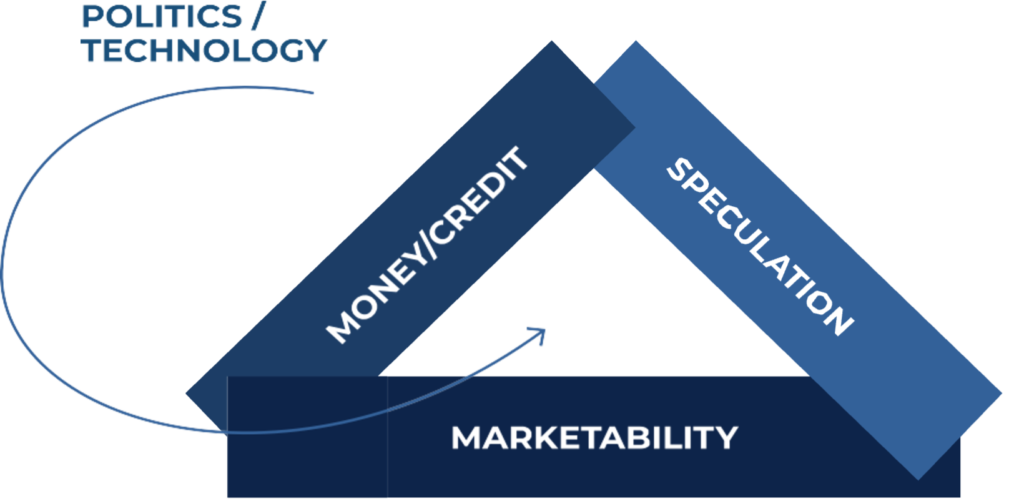

The Bubble Triangle: a universal definition of speculative bubbles

The “Bubble Triangle”[1] was developed by studying past bubbles to identify the commonalities between them. It consists of three elements: marketability, money/credit and speculation. These components interact in various ways to fuel the rise and eventual burst of financial bubbles, often requiring external forces such as a political change or a new technology to ignite their formation. While one can apply this framework to bubbles ranging from Tulip Mania in the 1600s to the Roaring Twenties,[2] we will use it to evaluate whether the hype around artificial intelligence (AI) has potentially created a new bubble.

The first side of the Bubble Triangle is called ‘Marketability’ or the ease with which a financial asset can be freely bought and sold and is the “oxygen” needed to fire up a boom. Marketability is also related to how divisible a financial asset is. For example, if a buyer can buy just a small amount of an asset, that means they will be more likely to do so as the initial investment is not that risky. How easy it is to transport and store a financial asset is also important for marketability, as something that is heavy and dangerous is unlikely to cause a bubble, but a weightless digital asset is perfect.

The second side of the Bubble Triangle is ‘Money/Credit’ Expansion (or the “fuel”). If money and credit are tight it will be difficult to borrow money from banks to purchase new, especially risky, financial assets. But if banks are extending credit freely, investors can borrow in the “sure and certain” hope they can make a profit and repay the loan.[3] If the asset appreciates as hoped, then everyone will be happy.

The final leg of the triangle is ‘Speculation (or “heat”)’. Just as a fire will not ignite without sufficient heat applied to the fuel, a financial bubble will not form without enough speculative activity. Speculation encompasses the psychological and behavioural dynamics that lead investors to engage in irrational, herd-like behaviour. Driven by a fear of missing out on potential gains, investors may exhibit excessive optimism, overconfidence and a willingness to invest in assets with little regard for their actual value. This speculative frenzy, where investors chase rising prices, is a crucial driver of bubble formation and growth.

The interplay of these three elements creates a self-reinforcing cycle that can lead to the rapid inflation of asset prices. However, this cycle is often ignited by external forces such as a political change or a new technology, which can disrupt established valuation metrics and create the conditions for a potential bubble to form.

Ultimately, this interplay continues to grow if these forces interact. However, any disruption to these elements, such as tightening credit conditions (interest rate increases), loss of investor confidence (recession) or changes in marketability (closure of exchanges) can trigger the bubble’s collapse, leading to a sharp decline in asset prices. This can extend further into a full banking crisis depending on the degree of debt and leverage taken on, resulting in significant economic disruption.

Figure 2: The core tenets of speculative bubbles

The latest bubble?

The rapid advancements in AI technologies over the past few years have captured the imagination of investors, entrepreneurs and the public. However, there are growing concerns that the current hype surrounding AI-linked stocks may be indicative of a bubble in the making.

Rather than speculate, let’s assess whether the AI market exhibits the characteristics of the Bubble Triangle framework:

External causes

The external factor in this case was the launch of ChatGPT in November 2022. Although it has long been argued that AI is the most significant technological innovation since the launch of the Internet, it was only with the launch of ChatGPT that the public became aware of the advances AI had made in generating human-like conversations, solving complex problems and assisting with various tasks. This created a surge in interest and confidence in the potential of AI technology across different industries. As a result, companies involved in AI development – such as those offering software, hardware and data services – experienced increased investor interest, which contributed to a rise in AI stock values.

If we consider a company like Nvidia in particular, their graphics processing units (GPUs) are highly suited for the complex calculations needed for AI tasks like deep learning, machine learning and data processing. GPUs, originally designed for video gaming, excel at handling parallel processing, which is essential for training large AI models. As demand for AI grows across industries – like autonomous vehicles, healthcare and cloud computing – so the demand for Nvidia’s products grows too. While Nvidia benefits from demand for their hardware, the rest of the Magnificent 7 – Apple, Microsoft, Alphabet (Google), Amazon, Meta (Facebook) and Tesla – are all deeply involved in AI, but in different ways.

Moving onto the three parts of the Bubble Triangle:

Marketability

There has been one clear driver of increased marketability in recent years. There is the rise of retail investor online stock trading platforms such as Robinhood which have “gamified” stock ownership with their ability to instantly trade stocks in small denominations at close to zero fees. Robinhood alone has introduced over 23-million new “investors” to the stock market.

Money/Credit availability

There have been two key drivers of increased money supply and credit availability over the past few years. The first was the fiscal stimulus provided to individuals by many governments, including the US, during the Covid pandemic. This was done to help people cover basic needs while the economy was struggling. However, not everyone needed the cheques for immediate expenses. For many individuals, whose jobs were secure and expenses like travel or dining out were reduced, these stimulus payments led to increased savings [4]. With extra savings and easy access to online trading platforms like Robinhood, more people started investing in stocks. The combination of savings, low interest rates and market hype (especially in sectors like tech and AI) encouraged many individuals to trade and invest more actively.

The second driver has been the amount of “dry powder” or excess cash available to both private equity and venture capital firms. As private equity investing has become more popular and seen large inflows of capital, these firms have needed to invest this capital. This has seen a surge in capital chasing a limited number of opportunities. Private equity investment into just one AI sub-sector rose from $0.04-billion in 2018 to over $2-billion in 2023. Venture capital funding for AI was over $47-billion in 2023 alone. Given the limited amount of opportunities in private markets, and the excess cash available, we have seen spillover in public equity markets with the likes of SailPoint taken private in a $6.9-billion deal by Thoma Bravo, a private equity firm, in 2022. This type of transaction increases the price premium for other AI-related companies.

Speculation

The current narrative around AI companies draws strong parallels to the Dot-Com Bubble. Just like during the dot-com era, stock prices are surging on speculation as they announce new AI projects or developments which could deliver profits but have no clear avenue to do so. The risk is that many AI-related companies with no real profits or business models are attracting massive investments, only to potentially crash when the hype can’t be sustained.

As an example of this, BuzzFeed (a digital media company) announced that they would integrate AI to create content for their website. After the announcement, BuzzFeed’s stock surged by over 150% in just two days. Only to fall in the following months as it became clear that there was no path to improved profitability from the AI integration.

This highlights why the effect of the marginal investor on bubbles is also an important consideration. Retail investors are generally more susceptible to speculative and herd behaviour, which can contribute to the formation and growth of asset price bubbles. In contrast, institutional investors, with their greater access to information and more disciplined investment approach, are less likely to drive bubble dynamics. The dominance of retail investors in a market can therefore increase the likelihood of bubble formation, as their emotional and trend-following behaviour can amplify speculation. The rise of the retail investor, particularly in US equity markets, has been a hallmark of the potential bubble-building in AI-linked asset prices.

While the development of AI technologies holds immense promise, the current hype and price behaviour of AI-linked stocks may very well be indicative of a bubble, especially given that every single one of our Bubble Triangle criteria is being met. However, it is essential to note that the AI industry is still in its early stages, and the long-term impact of these technologies remains uncertain. As the AI industry continues to evolve, there is the potential that some companies like Nvidia, where there are good underlying businesses, can generate positive returns for investors despite price action. The starting point is tough though, with high expectations already reflected in share prices.

That is the challenge with markets. You cannot say with certainty that you are in the midst of a bubble. You can only test it against previous experiences. Ultimately, the approach to navigating markets should not be binary. The key is to apply a disciplined, fundamentally driven approach that carefully evaluates the underlying merits and risks of specific opportunities, while also maintaining a diversified portfolio that can weather the ups and downs of the market cycle.

- [1.] This framework was created by Quinn, William, and John D. Turner and popularised via their book: Boom and Bust: A Global History of Financial Bubbles. Cambridge University Press, 2020.

- [2.] The “Roaring Twenties” refers to the 1920s, a decade of rapid economic growth and speculative investment, fuelled by easy credit and investor optimism. This created a bubble in stocks and real estate. The bubble burst in 1929, leading to the Wall Street Crash and the onset of the Great Depression.

- [3.] Margin lending is the practice of borrowing money from a broker to buy securities, using the purchased securities as collateral, allowing investors to leverage their investments but increasing their risk.

- [4.] By mid-2020, the US personal savings rate hit a record 33%.