Record of advice: various definitions often lead to misinterpretation

Anton Swanepoel, Founder of Trusted Advisors, states that some advisors refer to the client proposal as the record of advice and others refer to a quotation as the record of advice, both of which are only partially correct.

Creating procedures with ChatGPT

Francois du Toit, PROpulsion, shares his guide to creating SOPs using ChatGPT.

Do DFMs just add to costs?

Nadir Thokan, Senior Discretionary Fund Specialist at Alexforbes, on the downward trend of DFM fees.

Why umbrella funds belong in your EVP strategy

Niki Giles, Head of Strategy at Prescient Fund Services, unpacks how Umbrella Funds can help South African businesses rethink their Employee Value Proposition and safeguard long-term savings — while easing administrative burdens.

Looking forward to a RAG-based future

Professor Evan Gilbert and Paul Nixon, Momentum Investments, provide answers to why AI is going to be a part of the future of financial advice.

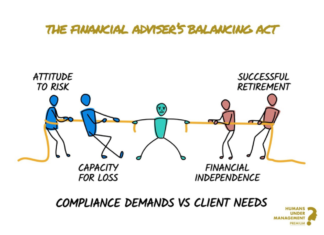

Choose your poison

According to Any Hart, Founder of Humans Under Management, financial advisors must champion their clients’ futures, confronting misguided compliance systems that obscure the real risks – capital loss, inflation, and poor returns – while working towards a framework that truly safeguards financial well-being.

INN8 Invest

INN8 Invest leverages global expertise and a disciplined, research-driven approach to deliver consistent, long-term investment performance while empowering financial advisors and investors through best-in-class discretionary fund management solutions.

Understand the price you pay for investing in America

Anyone who has travelled to the United States recently has at some point experienced “sticker shock”. For those looking to invest in American companies, the experience may be no different, writes Jonathan Wernick Global Equity Analyst, Sasfin Wealth.

Who should pay the DFM its fees?

Investors pay for the expertise of a Discretionary Fund Manager (DFM), but the fees are often offset by access to cost-saving strategies and discounted fee classes—ensuring that professional portfolio management remains a valuable investment. Learn more here.

To invest successfully, clients must overcome the Wall of Worry

Global events and investment market movements mean less than you think when it comes to successful investing, writes Rob Macdonald.

Most Popular

Money Maestros Conference 2025 — One Day. One Venue. World Class Speakers.

Be part of the conference that brings together 7 of the most impactful speakers from across the US, UK and South Africa — built to energise, inspire, motivate and your thinking in a single powerful day.

If you don’t pay, you don’t stay

Tim Slatter, Director at Slatter Communications looks at why authentic communication could be a hidden key to client retention.

Trump 2.0

Rob Macdonald, Independent Consultant, encourages financial planners to focus on their Circle of Control. The more you have planned your communication and implemented it consistently, the more likely you will influence client behaviour.