The DFM industry has grown at an impressive 20% annual rate over the past three years, reaching an estimated R500-billion in assets under management. The latest NMG Retail Wealth Survey shows that IFAs are placing greater value on their DFM relationships, while ties with asset managers are becoming less relevant. With 73% of IFAs surveyed planning to expand their use of DFMs, this trend is set to continue and gain even more significance.

Two key questions remain:

How has the rise of DFMs impacted a client’s Total Investment Charge (TIC)? Are DFMs simply an added cost, similar to retail multi-managers?

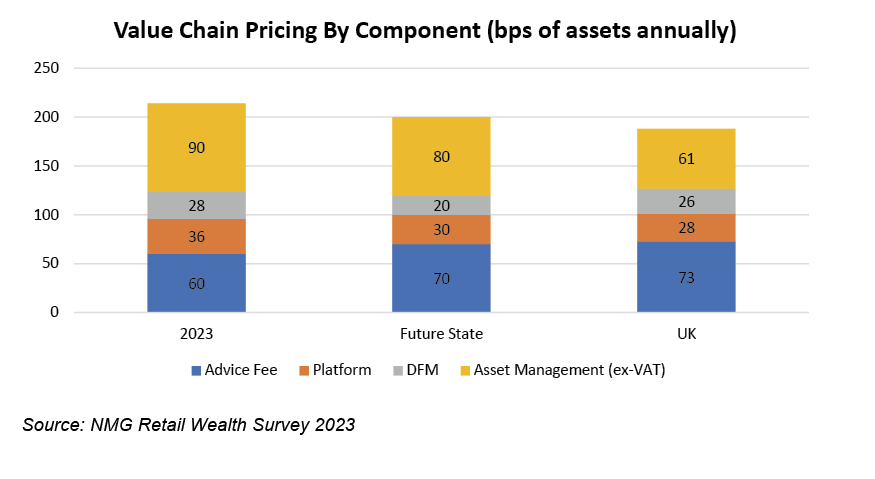

With a growing shift towards low-cost passive and rules-based strategies, cost efficiency is a priority. DFMs must demonstrate value beyond fees, including benefits like partnership, succession planning, operational efficiency and performance. Early data shows that TICs for DFM-run solutions have been decreasing, especially for the most expensive options. For instance, in the ASISA Multi-Asset High Equity category, the highest TIC has dropped from over 2% in 2021 to around 1.75% in 2023 – a 12.5% reduction. Further confirmation of this gradual compression in overall fees even with the inclusion of a DFM is depicted in the chart below.

What is notable from this is that while overall costs across the investment value chain, including DFMs, are decreasing, fees are rising for parts closest to the end client – where clients see the most value. This highlights a key benefit of DFMs: over time, they enable advisers to justify higher advice fees by allowing them to focus on adding more value. Looking at the UK, where DFMs are more established, the trend suggests that total fees across the value chain will likely continue to decline, even as DFM fees increase.

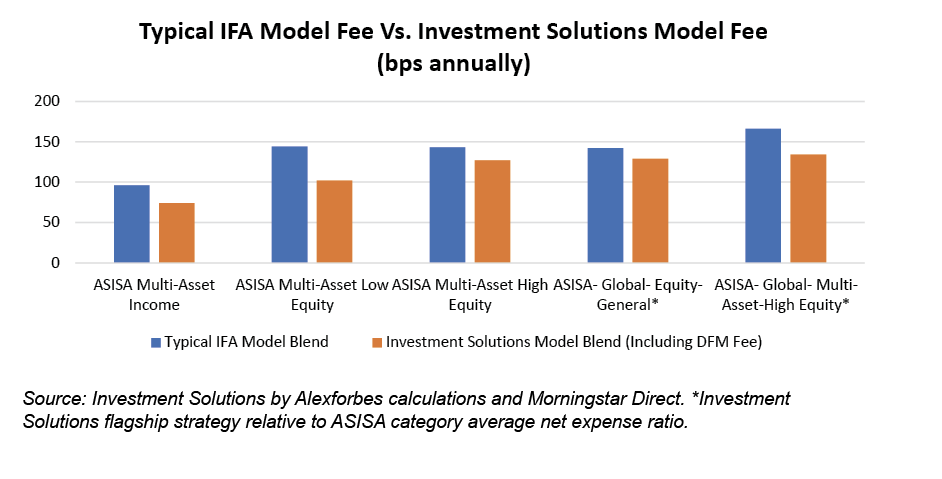

While it’s reassuring that total fees across the value chain, including DFM fees, are trending downward, this doesn’t clearly show how DFMs help reduce overall investment management fees. To assess this, we need to separate total investment management costs (DFM and asset management fees) from other expenses and compare how they change with a DFM. The chart below right illustrates this for the Alexforbes Investment Solutions flagship DFM model range, compared to a popular IFA blend of funds within each ASISA category. The IFA fund blend is based on the largest, most invested funds in each category for a typical Category 1 IFA business. This analysis uses the retail fee class available on major LISP platforms for IFAs.

As noted above, a DFM of scale typically utilises the following factors to bring more cost-effective solutions to the market for the benefit of IFAs, as well as the end investor:

- Using scale to negotiate institutional-scale management fees with underlying asset managers. Typically, DFMs have amassed scale across multiple IFA and wealth management clients. This scale enables access to discounted fee classes with underlying asset managers. Larger DFMs with more significant assets to allocate benefit the most from such negotiations. A DFM with the scale, longevity and track record of Investment Solutions makes a significant impact.

- Offsetting a portion of the DFM fee due to the DFM’s own funds being included in the underlying model solution where such a building block fits within the best advice framework.

- While not applicable to the chart above, where a DFM constructs a bespoke fund for an IFA or wealth manager, such funds could leverage further fee benefits by including underlying manager fee classes, negotiated directly with the asset manager, without a requirement for such a fee class to be available on a LISP platform as the fund or fund solutions will be made available for client consumption on the LISP.

While this analysis focuses on Investment Solutions by Alexforbes, it is widely accepted that a DFM partner should be able to secure lower asset management fees because of their scale. In fact, access to lower fee classes is consistently ranked among the top four priorities for IFAs when choosing a DFM partner (NMG Retail Wealth Survey 2023). While some larger wealth managers negotiate fee discounts with asset managers based on their asset volumes, DFMs typically secure even better rates due to their larger allocations. As DFMs have grown in prominence, asset managers have adapted by reducing retail distribution costs, benefiting from DFMs as a strong, centralised source of retail flows.