“Skate to where the puck is going, not where it has been” – Wayne Gretzky

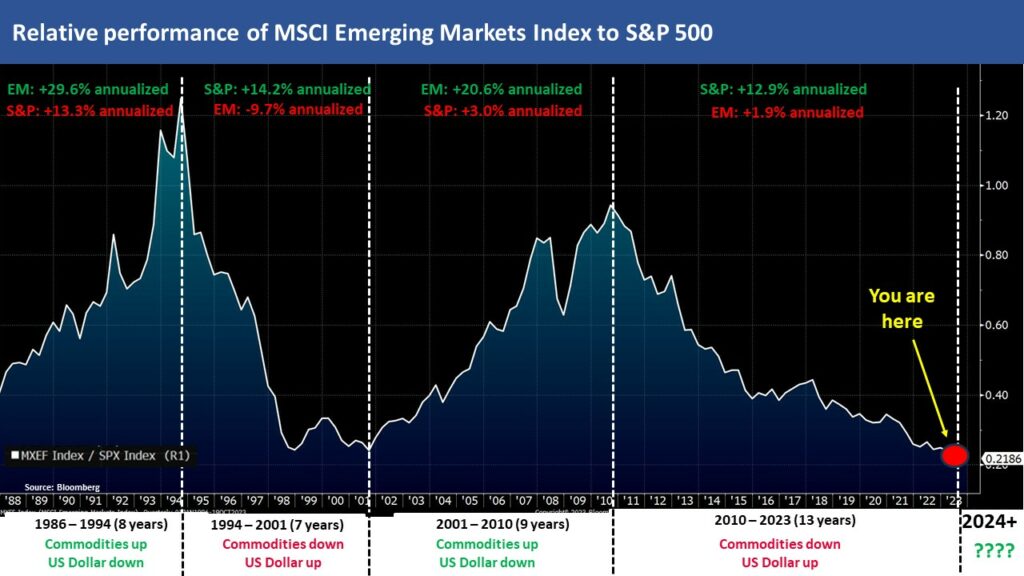

Markets, like many other phenomena driven by human behavior, tend to move in cycles. Since 2010, those who invested in the US (and US tech in particular) have generated wonderful investment returns. The S&P 500 has generated 13% annualized returns (in USD) for the last thirteen years – which is a great result. This is in stark contrast to investors in Emerging Markets, whose returns have been a paltry 1.3% annualized for the same thirteen-year period. Given such a long run of outperformance by the US, it is easy to forget that US outperformance is not always the case. In the decade prior to 2010, it was in fact the exact opposite– the S&P languished, returning 3% annualized over the nine years from 2001, while Emerging Markets soared, generating annualized returns of 20.6% for the same nine-year period. Today, after an unusually long period of US outperformance, it is critical as investors that we consider our starting point and “where the puck might be going”. The future may look quite different from recent history and from our vantage point, the outlook for Emerging Markets from here is exceptional.

Let’s consider our starting point

US markets are expensive. A thirteen-year bull-market has resulted in valuations that are by some key measures extraordinarily expensive. The Cyclically-Adjusted PE¹ for large cap US stocks is at a level only eclipsed three times prior – in 1999, 2007 and November 2021 – none of which boded well for investors (Dotcom bubble, GFC and Fed lift off respectively). Other developed markets do not look encouraging either for that matter. On the other hand, Emerging Markets, after 13 years of going sideways, are cheap – very cheap in fact. On a relative PE basis Emerging Markets are literally at 20-year lows compared to the US.

In fact, if we look back to the inception of the MSCI Emerging Market index in 1988, Emerging Markets have only once in 35 years been as cheap relative to the US markets as they are today. This was during the period of 1998-2000. During these heady years, US markets were surging in the late stages of the dotcom bubble, while Emerging Markets were reeling in the wake of the Asian financial crisis – a truly staggering period of extremes on either side, which preceded a bull market where Emerging Markets outperformed the S&P by 18% per year for the subsequent nine years.

Looking at the chart below chart, one can clearly see the multi-year cycles of over- and then underperformance between EM and DM over the last 35 years. What is less obvious is that these cycles are also correlated with two other variables: the US Dollar and commodities. Emerging Markets have historically done very well in periods of US dollar weakness and relative commodity strength.

With this in mind, what is the outlook for the US Dollar and commodities in the years ahead? Both of these topics warrant lengthier discussions than are possible here, suffice to say that the US dollar appears extremely expensive on a Real-effective Exchange Rate² basis versus its own history, having peaked in late 2022 at a level only seen twice before in 50 years. Commodities too appear cheap, with some compelling structural reasons for higher prices in the years ahead, particularly for resources required in the green transition.

Investors aren’t seeing the puck

With such an exciting backdrop, one might think that investors would be lining up to position themselves in Emerging Market assets? You would be mistaken. Thirteen years of lackluster returns while US markets have soared has ground down investor interest, and recency-bias has resulted in a significant under-allocation across Emerging Markets, even for their current weight and significance.

Emerging Markets contain 80% of the world’s population, make up 40% of global GDP, yet only comprise 27% of global stock market capitalization³. Meanwhile their weighting in the MSCI World Index is lower still at only 13%. Current investor allocations are even lower still, sitting between 6% and 8% according to major databases.

In the years ahead, Emerging Market economic growth, buoyed by healthier demographics and rising per capita GDP, will continue to outstrip developed markets. By 2050, it is estimated that Emerging Markets will dominate the world’s top 10 economies and as per capita GDP rises, EM share of global stock market capitalization will too. Goldman Sachs recently estimated that Emerging Markets’ share of global stock market capitalization would rise from 27% today to 47% by 2050. Whatever the eventual number, the direction of travel is clear –

Emerging Markets will continue to grow in economic significance in the decades ahead – and investors are materially under-allocated.

While there may be bumps in the road ahead, for those investors with a sense of where the puck is headed, the current starting point presents an excellent opportunity.

¹ The Cyclically-Adjusted PE (or CAPE Ratio or Shiller PE Ratio) is a long-term PE ratio that divides the price of a stock by the average earnings over the prior 10 years, adjusting for inflation. Its aim is to calculate a valuation measure that is independent of short-term fluctuations of the business cycle – and it has a remarkably strong correlation with subsequent 10-year returns. Like most measures, it cannot predict short-term movements, but for comparing the long-term and relative attractiveness, it is very useful

² Real-effective Exchange Rate (REER) is a measure of a currency’s strength relative to a trade-weighted basket of other currencies, adjusted for inflation. It is a useful indicator of a currency’s relative strength and is a much more useful measure of a currency’s strength than any other bilateral rate.

³ i.e the value of EM stocks as a proportion of the value of global listed stocks.