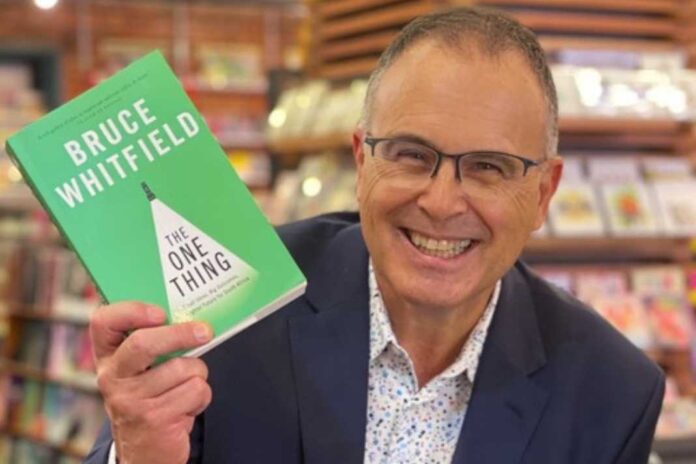

| Bruce Whitfield is the host of “The Art of Deciding” podcast in which he interrogates high-profile professionals around the world on how they make life-changing decisions. He is the author of three best-selling books and is working on a fourth. He is a sought-after professional speaker who hosted The Money Show on 702 and CapeTalk for more than 20 years. |

What led you to working in financial journalism?

At about 2am on Sunday 15 March 2000, I had a conversation with a former colleague about what they were doing, and he revealed he was at a little startup that had a radio show, a website and big ambition. Two months later, I joined Moneyweb after 10 interviews in which no-one believed me when I asked, “So, what is this All-Share Index thing you guys talk about?” They soon found out that I did not have a clue… luckily, I was a fast learner.

Upon winning the Harry Brews’ Award, you said the goal in your work has been to bridge the gap between expert financial advice and the public. What have you seen as the biggest challenges in bridging this gap?

Learning about money is like learning a new language; increasingly difficult to do as you get older. Business terminology and even the language of financial advice can be alienating and intimidating and because most people don’t want to appear ignorant, they don’t ask questions and therefore don’t understand much of what they are buying much of the time. I also noticed how so much of the selling around investments was done on fear and the “Do you want to live on cat food?” principle. It’s changed a lot over time, but I became determined to talk positively about money and find ways to inspire investing rather than amplify the downside of not doing so.

When it comes to investing, the media can be seen as friend and foe, offering education on the one hand, and hype on the other. How did you get the balance right?

A loaded question! The problem is that very few journalists understand money and markets and look for stories that will get attention because that pleases their bosses. No real journalist I know wants to get things wrong and I suspect much of what riles the investment community about media could be addressed through gentle coaching rather than hostility and admonishment. The Sanlam Winter School for journalists is wonderful, but intensive and unless participants are immersed in financial news, too little sticks. I have found real relationship-building between the industry and journalists helps, not to manipulate coverage but make it better. A journalist’s job is to draw attention to what is wrong, not be a PR mouthpiece – that is called advertising and costs money.

You regularly used to interview businesspeople and personalities about how they managed their money. What are some of the key lessons that stood out for you from these interviews?

I have a short attention span and get bored easily so I skipped the formulaic stuff and instead found interesting tales of differentiation like Michael Fridjohn’s wine cellar and Michael Vlismas’ art habit, for example. Talking to people explaining why they prefer balanced funds over general equity funds is not interesting. My personal realisation is that independent advice is a critical success factor for people who achieve financial independence.

For over a decade you hosted former Financial Planner of the Year, Warren Ingram, on your show. From the conversations with Warren over the years, what stands out for you as the biggest things that people struggle with when it comes to their money?

People are driven by fear rather than the potential of what is possible. When the conversation is too focused on scarcity and risk people are more likely to make silly mistakes in times of crisis.

There needs to be more conversations about the power of growth over time and real education beyond the slogans like, “It’s not timing the market, but time in the market,” which is true but exhausted and over-used. Warren introduced me to “Julia” whose story we told annually in savings month as an antidote to the tired theme: “Only 6% of South Africans have enough money to retire…” It may be true, but it’s uninspiring and done. Find new and interesting ways of doing it.

What is the biggest mistake you have made with your own financial planning?

Starting too late and not being sufficiently aggressive. Paying off long-term debt too fast rather than running a proper strategy and, and, and. The cobbler’s children have no shoes…

What is the most important lesson about money that you learned from hosting The Money Show?

Ignore the noise. Following the underlying trends of development and innovation and ignoring the hype of the day to day. The five scariest events of the past two decades had dramatic, but ultimately short-lived impacts on markets. Invest money. Do it regularly. Forget about it.

What advice would you give to someone who is considering a career in financial journalism and/or financial planning?

Financial planning pays better.

You have recently launched a podcast about decision-making. What prompted you to choose this as the theme?

No-one else was doing it and it has been at the core of everything I have done for more than 20 years. It allows me to cut out the noise and focus only on what I find interesting and relevant. So far so good.

Any advice to financial planners and/or the Financial Planning Institute about how they can best serve clients?

Find new, provable stories to tell to inspire what is possible. Please.