Sustainable investing is not just about a company’s financial success, but how it achieves that success. The importance of considering all stakeholders is intrinsic to the approach.

Those stakeholders range from employees to shareholders to wider society. The Covid-19 pandemic has shone a spotlight on how companies treat their employees, protect their customers, and help guide their suppliers through a time of crisis.

With vaccines on the way, the effects of the pandemic should – hopefully – start to fade. We ask three sustainable investors at Schroders how the pandemic has changed the conversation around sustainable investing, and what they expect the long-term impact to be.

Has the pandemic changed how you, as investors, speak to companies?

Katherine Davidson, Schroders’ Global Sustainable Growth Portfolio Manager: “The dialogue has changed between investors and companies. ESG (environmental, social, governance) concerns used to be mainly discussed in terms of the “E” but this year it’s become very clear that the social aspect is just as important. This is a broad conversation that’s happening in the media and wider society as well. How companies treat their staff, manage their supply chains and keep their customers safe is not solely of interest to investors.”

Nicholette MacDonald-Brown, Schroders’ Head of European Blend: “As sustainable investors, our engagement with companies for a long time now has included questions about how they treat all their stakeholders. But if I think back to the 2008 global financial crisis, the conversations then were very different to the conversations we’re having now. Back then, it was all about profit margins and balance sheets whereas now those things are discussed in partnership with the treatment of employees and suppliers.”

Will this focus on sustainability last?

Nicholette MacDonald-Brown: “I think it will last and in simple terms it’s largely down to investment performance. The relative success of sustainable funds this year is very important because it was their first big test. This shows that sustainability isn’t a ‘luxury’ that investors can only afford to think about in the good times; it’s crucial in tough economic times too.

Saida Eggerstedt, Schroders’ Head of Sustainable Credit: “I think the pressure for companies to demonstrate good practice has gone up. After all, there is plenty of choice for investors: the economic difficulties of this year have seen many companies seek new funding by issuing debt or equity. Investors can therefore be selective. Let’s not forget the role of governments and regulators in this too. Governments want to see high standards from companies in terms of social and environmental behaviour if they are going to get state help and this will extend beyond the current crisis.”

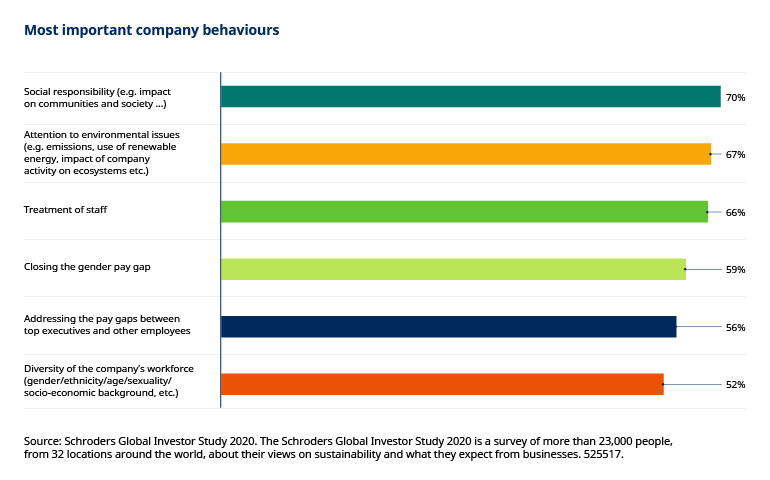

Katherine Davidson: “We’re starting to call it a new social contract, in that a company’s place in its community and wider society is changing. This is important for clients too. The latest Schroders Global Investor Study showed how people expect companies to prioritise the actions that have an impact on the wider environment and society.”

How have companies reacted to questions about sustainability?

Saida Eggerstedt: “In some ways, the sharp market falls in the early days of the pandemic offered a good opportunity for investors like us to engage with companies over their response. It can be easier and more effective to press for best practice or greater transparency at a time of crisis, rather than when everything seems to be going well.”

Katherine Davidson: “One of the positives of the crisis is that it has enabled us to start engaging with companies who previously hadn’t seen the business case for sustainability. This year, capital markets have rewarded companies that are active on sustainability issues. We’ve also seen customers vote with their feet and brand perceptions fall if a company is seen to be a ‘bad actor’ in the crisis. This is the kind of thing that gets noticed by senior executives.”

Nicholette MacDonald-Brown: “As an investor in Europe, I’m fortunate that many of the companies I speak to are already thinking about sustainability issues. But it still gets their attention if I say that doubts over a sustainability issue make a company less investable, in the same way as doubts about their profit margins. What’s also very interesting is that we’re starting to see companies come to us and ask for advice about best practice on sustainability. The recognition that companies should put sustainability targets alongside financial targets is definitely growing.”

Do you think clients will increasingly seek out sustainable investments?

Katherine Davidson: “The pandemic has caused a lot of people to consider their values and what is most important to them. This has big implications for investing. For example, our latest Global Investor Study found that 77% of retail investors won’t invest in something if it’s against their personal beliefs.”

Nicholette MacDonald-Brown: “There’s often a misconception that there’s a narrow audience for sustainable products, or that only young people are concerned about sustainability. Perhaps that used to be true but it’s certainly not now. More traditional investors like insurance companies also care about sustainability and are starting to drive the conversation. The growing evidence that you can achieve your investment goals without compromising your beliefs is crucial in this regard.”

Any references to securities, sectors, regions and/or countries are for illustrative purposes only. The views and opinions contained herein are those of the authors, or the individual to whom they are attributed, and may not necessarily represent views expressed or reflected in other communications, strategies or funds.