At the time of writing, the Covid-19 crisis is wreaking havoc across international markets, interrupting global supply chains, drying up demand and, of course, taking a massive personal toll on affected families.

Given the scale of the devastation, some investors might ask: Why worry about Responsible Investing or ESG (environmental, social and governance) issues at this stage? Surely it makes sense to just focus on the ‘important’ investment numbers and rather leave the soft ESG stuff for after the crisis? In this article, I’ll argue that:

1) The current Covid-19 crisis has many important lessons that strengthen the case for responsible investing;

2) The current downturn provides early but compelling evidence that ESG is not just a nice to have but it is also good to have; and

3) The ‘green economy’ has real potential to deliver long-term win-win outcomes.

Lessons from Covid-19

Lesson 1: We’re all interconnected

One of the founding principles of Responsible Investing (RI) is the interconnected nature of our social, biophysical and market ecosystems. Importantly, RI recognises the impact of unpriced externalities on the safe operation of the market, society and the environment. Examples include the social and environmental costs from burning fossil fuels or societal health impacts of high calorific foods. By considering externalities in its approach the RI field essentially asks all participants in the investment value chain to consider the wisdom of pursuing short-term returns at the expense of long-term resilience of social and environmental systems.

The Covid-19 crisis has laid bare the very real interconnectivity between our social, environmental and market systems. The lesson here is not to neglect interconnectivity and long-term system resilience.

Lesson 2: Shared value

Professors Kramer and Porter of Harvard Business School penned their famous article on Share Value in the early 2000s. In it, they argued that the best business strategy to adopt in a world with increasing social and environmental pressures was one that generated profits while providing solutions for long-term social and environmental resilience. They proposed a stakeholder inclusive model for capitalism which encourages value to be shared across participating stakeholder groups. In effect, this type of strategy requires company management to carefully consider a broad range of stakeholders and the associated business impacts. For some management teams, this is a sharp departure from the age-old adage that, ‘the business of business is business’.

As tough as the lessons from the Covid-19 crisis are, we expect that they will strengthen RI as an approach to investments.

Covid-19 puts a sharp focus on management approaches to human capital management, corporate culture, and the treatment of customers. Corporate responses around these issues can potentially have lasting impacts for all company stakeholders.

For investors that are ESG literate, it’s no news that workforce management, employee satisfaction and corporate culture, have a long-term impact on productivity, share price performance and returns. Similarly, companies’ treatment of customers is an important driver of brand equity and improved customer relationships over time. How management teams respond in this time of crisis will be telling for their long-term profitability.

Aside from management practices, the Covid-19 crisis also exposes the underlying business model, specifically what goods and services the company provide. As we are collectively finding out, essential services mean something very specific. It redefines what we can and can’t do without and what we are prepared to pay for. Business models that provide solutions for food security, connectivity, online education, entertainment, sustainable mobility, finance, water, energy, sewage, waste, health care, etc. have prospects for growth.

Those investment teams with deeply integrated ESG processes will no doubt be attuned to these issues. They will have a view of which business models and management teams are therefore best placed to retain value through the cycle. Covid-19 has been indiscriminate in whom it infects, and doing so it has become everyone’s problem. Those with the best chance of fighting it are doing so collaboratively across a broad range of stakeholders. The Covid-19 crisis reminds us of the power of working proactively with all stakeholders to achieve shared value outcomes.

Lesson 3: Understanding the science

As a consequence of its focus on ESG issues, the field of RI relies on scientific data to make the business case for sustainability. Most asset managers with a focus of RI will thus have a clear understanding of the science behind climate change and the attendant risks and opportunities. Notwithstanding this, in the current age of populist politics, the role of science has increasingly taken a back seat.

The Covid-19 crisis reminds us of the power of working proactively with all stakeholders to achieve shared value outcomes.

Despite being one of the most scientifically peer-reviewed publications produced by humanity, the Intergovernmental Panel on Climate Change assessment reports failed to inspire political leadership. Although the Covid-19 crisis is more near term compared to climate change, it is instructive to see how rapidly political leaders, despite their differing views, have fallen in line with prevailing medical and scientific consensus.

The lesson of Covid-19 is to not forget the science. Importantly those asset managers with these specialist skills will be well placed to look ahead. As tough as the lessons from the Covid-19 crisis are, we expect that they will strengthen RI as an approach to investments.

ESG is a good to have

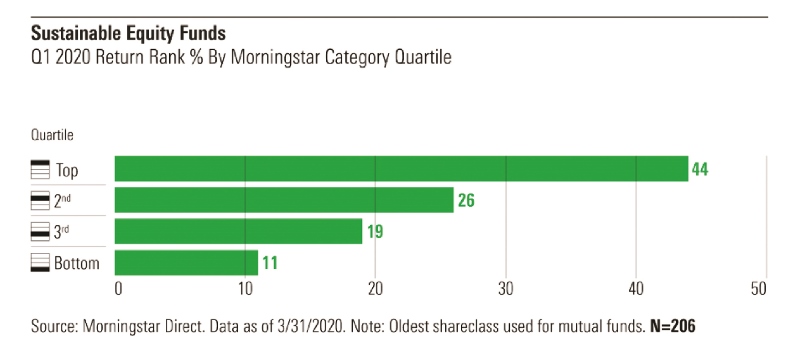

Like all funds, sustainable equity funds suffered large and sudden losses of value in the first quarter of 2020 due to the global coronavirus pandemic. Direct Morningstar reports that sustainable investment funds held up better than conventional funds during this period. They report that seven out of ten sustainable equity funds finished in the top halves of their Morningstar categories, and 24 of 26 environmental, social, and governance-tilted index funds outperformed their closest conventional counterparts.

ESG funds favour companies with better ESG credentials and as such, they can be expected to manage their environmental impacts, treat their stakeholders well, and ethically govern themselves. It appears that such businesses have been more resilient during this crisis and are showing themselves to be the new ‘quality companies’ of the 21st Century.

Strangely, the Covid-19 crisis has provided a good litmus test for the quality management argument around ESG investing and provides further support to the idea that ESG integration is not just a nice to have, but it is also a good to have.

Perusing Green Growth

As society seeks to rebuild in a post-Covid-19 world, we expect the idea of Green Growth to continue to gain traction. The notion of Green Growth rose in the aftermath of the last financial crisis as alternative growth path, one guided by climate awareness, resource efficiency and social inclusion.

At a global level, Green Growth features in national growth strategies and the EU is putting in place legislation to drive and incentivise these kinds of outcomes. At the local level, National Treasury recently published a technical paper on Financing a Sustainable Economy and work is underway to develop a Green Economy taxonomy for South Africa.

Green Growth is not only a scientifically bounded economic idea but is also as a set of globally consistent consumer preferences, as more and more consumers align with the sustainability agenda. Doing more with less has always been a good idea, as has caring for the environment along with being a good neighbour.

What next?

It is not clear what’s next, the Covid-19 pandemic is unprecedented in modern times. There is much we don’t know about how this plays out; however what we do know is that the world will be much changed. Our sense of interconnectivity will be enhanced, we’ll have learnt that it’s not just returns that matter and that business-focused term shared value outcomes will survive.

For too long we have bought into the notion that short-term market relief while extending long-term social and environmental decline, is a good idea. The current moment provides an interesting opportunity to align Covid stimulus packages with long-term sustainable outcomes.

Is this the moment when the world decides to shift towards a global economic path that is low carbon, resource-efficient and socially inclusive?

Is this the moment when the world decides to shift towards a global economic path that is low carbon, resource-efficient and socially inclusive?

Jon Duncan, Head of Responsible Investing, Old Mutual Investment Group. Jon has over 23 years of experience in the field of sustainability research and engagement. He has led the Responsible Investment Programme at Old Mutual for the past 10 years.

His focus is on driving the systemic integration of material environmental, social and governance (ESG) issues into the products and services of Old Mutual Investment Group.