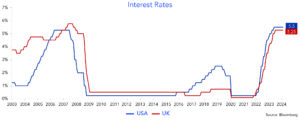

Fresh from a market rally in the final six weeks of last year, markets began the first quarter of 2024 optimistic that declining inflation would lead to meaningfully lower interest rates. As the quarter progressed, however, it became evident that inflation was sticky and interest rates would, therefore, need to remain higher for longer.

Jerome Powell confirmed this at the latest Federal Open Market Committee (FOMC) meeting where the benchmark interest rate was kept unchanged at a two-decade high. At the meeting, it was noted that interest rates would only be lowered when the committee had gained sufficient confidence that inflation was moving sustainably toward 2%.

Similarly, the Bank of England’s Monetary Policy Committee (MPC) opted to maintain the bank rate at 5.25%. As a result, First World interest rates will remain elevated for some time, particularly in the US where economic growth remains robust. Investors are therefore still able to achieve attractive hard currency returns from low-risk investments – an investment opportunity that has been missing for the past 15 years.

To help investors take advantage of this opportunity in the most tax- and cost-efficient way possible, Marriott has launched the Smart International Income Portfolio (SIIP) – a simple, low-cost investment for conservative investors looking to achieve hard currency returns in excess of bank deposits in either US Dollars or Sterling.

The two portfolios only hold liquid, investment-grade instruments and yield 5.6% and 5.1% respectively.

Importantly, all interest-bearing assets are held via accumulating ETFs and funds. This is highly tax efficient for South African investors as the income is automatically retained within the portfolios without incurring tax. If capital is required, the investor can simply repurchase the required amount.

Although a tax charge is triggered at this point, it will be subject to capital gains tax as opposed to income tax – providing a large tax saving (up to 27%) for individual South African investors.

Looking forward, although major central banks are expected to begin cutting rates later this year, the trajectory is likely to be gradual, with interest rates remaining in restrictive territory until inflation is sustainably back at their 2% targets. As a result, Marriott’s SIIP is well-placed to provide investors with attractive hard currency yields in a highly cost- and tax-efficient way for the foreseeable future.

The two SIIP portfolios can be accessed via the International Investment Mandate (using your annual individual offshore allowance).

Smart International Income Portfolio

- Smart Dollar Portfolio (USD)

- Smart Sterling Portfolio (GBP)