At Linktank, our independent research and practical experience in working with financial planning practices consistently reveals that most advisors and intermediaries in South Africa utilise multiple overlapping software applications within their businesses, usually with no data-sharing mechanisms between them. This is often a result of efforts to address the increasingly complex demands of building a client base, effectively managing relationships, providing advice and implementation to clients as well as meeting regulatory requirements. Understandably, advisors tend to prioritise client engagement and compliance, which means that developing a “best-practice technology strategy” is not a primary focus. Consequently, when it comes to selecting and embedding technology, advice businesses tend to make the best decisions at the time to meet their most pressing needs, but often without a cohesive technology roadmap in mind.

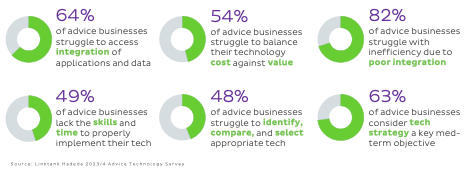

As a result, nearly three-quarters of practices end up with multiple datasets within their businesses, often containing duplications and variations, depending on the specific purpose of each technology solution in use. This issue is further compounded by numerous external data sources from various financial product providers and investment platforms, resulting in significant frustration, as evidenced by the industry challenges tracked in Linktank and Hadeda’s annual advice technology survey reports.

In an environment where integration between internal applications and those of product providers and platforms is very limited, and where competing independent software solutions don’t offer a sufficiently broad range of standard integrations to meet demand, we regularly work with advisory teams who spend way too much time managing client data. Manual input, duplicated across multiple interfaces, is the norm, followed by hours spent on manual collection, collation and cleansing of data, all to provide clients with, at the very least, consolidated reporting.

Trying to ensure that data is accurate and consistent across systems is challenging enough in itself; taking it a step further is therefore perceived as completely out of reach. Accessing the critical insights that can enable practices to better understand their clients, analysing the revenue they are receiving, supporting operational efficiency and tracking against strategic goals are essential ingredients to business growth that are frequently simply deemed too complex to produce. New legislation like POPIA and COFI bring reporting requirements that create an additional layer of complexity. This all makes for an environment of faulty foundations, upon which it becomes increasingly difficult to build onto by automating or leveraging new technologies like artificial intelligence (AI). When it is this challenging to achieve a “single view of the client” or to maintain an accurate and current source of truth, are there any strategies out there to support business intelligence and growth?

In a rapidly evolving financial and technological landscape, ensuring data accuracy and harnessing the power of that data can help practices make more informed business decisions. These decisions support optimal operations and provide more accurate reporting for both management teams and clients. While some software solutions offer business intelligence reporting as embedded features, these typically only provide insights into the subset of data stored within that solution. To achieve more robust and inclusive data analytics, an overarching solution is necessary – one that integrates data from multiple sources to provide a holistic view across the entire business and bridge the gaps created by unintegrated environments.

Over the past decade, we’ve seen every FSP data environment imaginable and have learned some tricks along the way. Data cleansing and integrity exercises are crucial for successful technology adoption, but they are only one part of the solution. Where automated no-code integration isn’t possible, business intelligence dashboards are a relatively quick, simple and non-invasive way of consolidating disparate information to achieve deep insights. The lack of expertise within the business needn’t be a stumbling block either, since businesses like Linktank are out there to help.

Essentially, dashboards are set up to collect “raw” information from multiple sources, such as internal practice management applications or revenue management systems or even external data in the form of Excel or CSV files from product providers. Source data doesn’t need to be moved outside of a practice’s own secure environment to feed the dashboards, thereby ensuring complete compliance with regulatory standards and data security protocols.

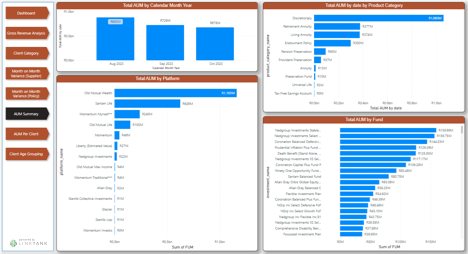

Using off-the-shelf tools, data can be queried, mapped and aggregated consistently and efficiently, greatly reducing the need for manual intervention and enabling practices to visualise their data in ways that make the most sense to them. Interactive charts, graphs and heat maps provide a holistic view of financial and other data, allowing stakeholders to make informed decisions quickly.

A simple set of business intelligence dashboards can address aspects like:

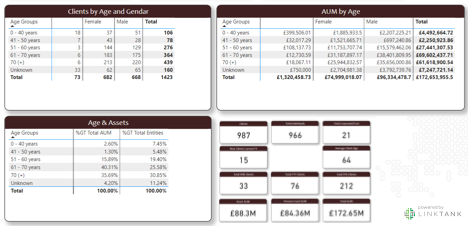

- Achieving a “single view” of clients, despite the fragmentation of their profiles across multiple applications and data sources.

- Understanding the risks and opportunities within a client base, such as determining the exposure rate of clients to business services or accurate segmentation.

- Visualising key financial metrics like assets under advice (AUA), client profitability and revenue trends.

- Supporting strategic decision-making and tracking against strategic and operational goals.

- Gauging the integrity and consistency of client data across various internal systems and highlighting “dirty” data.

- Tracking the effectiveness of client advice or implementation.

- Measuring user adoption, for instance to determine how well specific software features or processes are being used and thereby helping to measure the ROI of the business’ investment into technology.

- Managing KPIs and interrogating the efficacy of internal workflow processes.

In an era where data is a valuable currency, FSPs of all sizes can and should leverage advanced analytics to overcome the challenges that arise from poorly integrated environments.

Visualising data across a range of systems and sources ensures that decision-makers get a better understanding of their businesses and can reduce the risk of outdated insights, which impact both their operational and strategic decisions. Moreover, although AI tools are always available, without a clear understanding of the accuracy of your data or an ethical and compliant way of aggregating sensitive data, it will be extremely difficult to truly engage the functionality in a way which adds any real value to your business. But that is a conversation for another day.