In sport, certain players are described as individuals with big match temperament or “BMT”. Players with BMT just seem to have the ability to perform well in high-pressure situations, when it is needed most, and their trophy rooms are stacked with the evidence.

But when your clients are on the big stage, in this case retirement, how does their living annuity perform when they need it most?

In general, clients invested with an investment manager will have exposure to asset classes such as cash, bonds, property and equities, both locally and abroad. These asset classes create their performance through beta (B), which is the return generated by the market and sometimes through alpha (A), the performance though superior stock selection.

Yet, these drivers of return, being alpha and beta, come and go as no investment manager can always outperform or guarantee to do it when clients need it most. So, if A and B can’t always do it, what about using C?

Here, C refers to credits. And more specifically, to mortality credits. A mortality credit is the benefit clients can get from a life annuity because thousands of annuitants invest with the same life insurer and their mortality risk is pooled.

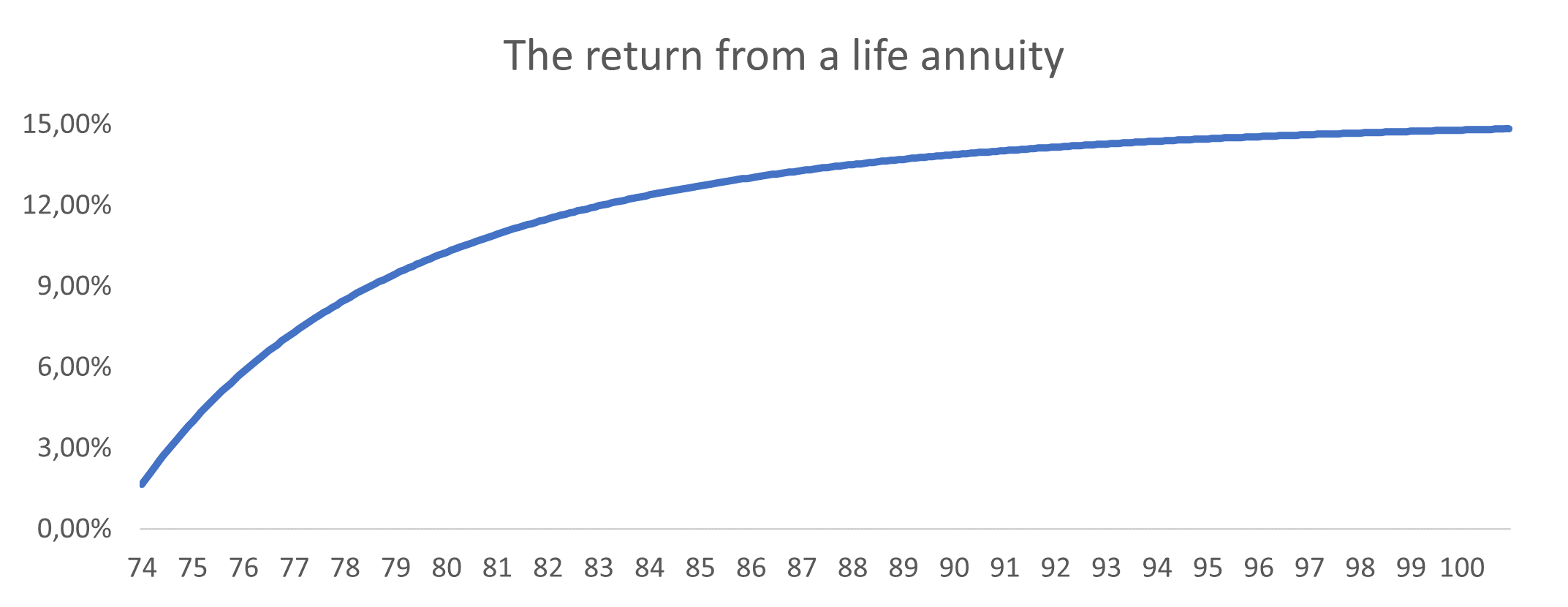

This pooling is the foundation of how a life annuity is priced so that the exact rand amount of income your client will receive is quoted. It is because not all clients will get the same value for money as they won’t all live to the same age. Some clients live longer than expected and receive an income stream that, when added together, could be six times or more than what they originally invested. In these instances, the income can have an implicit return or internal rate of return (IRR) of more than 14% (an IRR is the annual rate of growth that an investment is expected to generate). On the other end, clients may receive less than what was invested.

The reality is that life annuities will give a different return to different people, but the return is the highest when it is needed most, irrespective of how the future returns from markets turn out to be.

The reason why I say, “when it is needed most,” is because clients who live a prolonged life need a higher return on their assets. A client that needs 9.6% to maintain their increasing income need for 15 years will need 12.6% to maintain it for 35 years.

![]()

Clients who live longer in retirement are the ones who need the high returns the most. This is exactly what a life annuity offers. It offers a higher return the longer a client remains alive.

Calculations based on a R1-million life annuity for a male aged 65, which pays an income of R8 005 every month escalating at 5% every year. The return for periods shorter than 74 years are negative.

Calculations based on a R1-million life annuity for a male aged 65, which pays an income of R8 005 every month escalating at 5% every year. The return for periods shorter than 74 years are negative.

Source: Momentum Investments, date of quote June 2023.

This rate of return will vary on a case-to-case basis, but long-term returns approaching 14% and even 14.5% are not out of the ordinary when clients get the full benefit of mortality credits by living to an advanced age.

Momentum Wealth has recently expanded the choice of components that can be selected in our living annuity. We now offer a Guaranteed Annuity Portfolio – a life annuity as a component within our living annuity.

By using Momentum Wealth’s Guaranteed Annuity Portfolio within a client’s living annuity, you can provide a market-linked return as well as a return that increases with the client’s lifespan, thereby improving their chances of a successful retirement when they live to an advanced age.

Now, you don’t have to rely only on alpha (A) or beta (B) any more, you can trust that through C, ie mortality credits, your clients who need it most can have a successful retirement.

This is how Momentum Investments is making investing personal: with us, you can add some BMT to your clients’ retirement portfolios.

Momentum Wealth (Pty) Ltd (FSP 657) is an authorised financial services provider. Momentum Investments is part of Momentum Metropolitan Life Limited, an authorised financial services and registered credit provider (FSP 6406). The Retirement Income Option and the Guaranteed Annuity Portfolio are life insurance products, underwritten by Momentum Metropolitan Life Limited, a licensed life insurer under the Insurance Act and administered by Momentum Wealth (Pty) Ltd. The information in this article is for general information purposes and not intended to be an invitation to invest, professional advice or financial services under the Financial Advisory and Intermediary Services Act, 2002. Momentum Investments does not make any express or implied warranty about the accuracy of the information herein.