“The first rule of compounding: Never interrupt it unnecessarily.” – Charlie Munger

“The first rule of an investment is don’t lose money. And the second rule of an investment is don’t forget the first rule. And that’s all the rules there are.” – Warren Buffett

While most investors understand the importance of compounding, the impact of compounding over long periods can still be astonishing. Numerous academic studies have found that humans systematically underestimate the impact of exponential growth (ie compounding) through time. This is clearly illustrated with a well-known example. How many folds in half of a single sheet of 0.1mm thick paper would it take you to reach the moon? The answer is a mere 42 folds (I encourage interested readers to check the mathematics: 0.1mm x 242 ~ 420 000km vs the distance to the moon of 384 400km).

While the process of compounding (in the above example, a doubling) is extremely powerful on the way up, both the investing legends quoted at the start of this article caution about when the compounding is negative: in a geometric sequence of compounding, losses have a disproportionate impact on the result. Consider if you had R1-million invested and then lost 20%, leaving you with R800 000. From that point, you would then need a gain of 25% on your R800 000 just to get back to where you started. If you had lost 50%, you would need a gain of 100% to return to your starting point.

The avoidance of losses, especially large losses, is paramount to overall investment outcomes through time.

Another feature of compounding is that large single-loss events can severely disrupt a long-term process of compounding. Consider an investment that returned 25% annually for 10 years and then lost 90% in the 11th year. That investor would be down on his initial capital, despite 10 straight years of fantastic returns and one terrible year.

The nature of compounding means that despite the arithmetic average of the annual returns over the 11 years being 14.5%, this is irrelevant to the poor investor who has lost initial capital and whose compound annual return is negative. You cannot eat arithmetic returns. Investors live in a world where losses are also compounded through time and a solid record of annual average returns can be undone by a single large loss. The avoidance of losses, especially large losses, is paramount to overall investment outcomes through time.

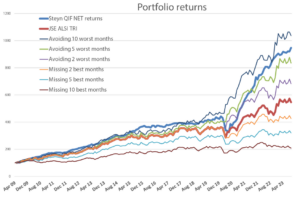

It is therefore unsurprising that the positive impact on a portfolio which simply avoided the 10 worst months on the JSE over the last 14 years is more than 50% greater than the impact of missing out on the 10 best months. It is far more important to avoid the losses than it is to take full advantage of market rallies.

Consider an investor who invested R1-million into the JSE ALSI on 1 May 2009 (the launch date of the Steyn Capital QI Hedge Fund). By 30 September 2023, this ALSI portfolio would have been worth R5.3-million. However, if this investor was a savant with perfect knowledge of the future and who simply skipped the 10 worst months on the JSE over the next 14 years, his portfolio at 30 September 2023 would have been worth almost double the ALSI portfolio, at just over R10.3-million. Said differently, sitting out just 6% of the months over the 14-year investment period adds the equivalent of five times the investor’s starting capital to his result.

This is the power of compounding. Conversely, had the investor instead been so unfortunate as to miss out on the 10 best months, his investment would be worth just over R2-million, a pedestrian result to be sure, but in rand terms far less impactful than the gain of avoiding the worst months.

The chart shows the portfolio outcomes for a range of scenarios our savant may have chosen.

One of the significant advantages of hedge funds is their ability to harness this phenomenon by mitigating downside risk while still participating in market upside. Indeed, one of the key characteristics of the Steyn Capital hedge fund strategy is our strong focus on downside protection, which since inception has significantly reduced both the frequency and depth of portfolio drawdowns, allowing the magic of compounding to do its thing.

In fact, in the 10 biggest monthly drawdowns on the JSE since the inception of our strategy, our strategy has generated a positive median

return, with the median return of our strategy across all the JSE down months being positive 0.8% compared to the JSE ALSI median return of -2.4%. The cost of this downside protection is that in months of blistering market rallies, we’re unlikely to keep up. But for long-term investors, who understand the power of compounding and who rightly focus on the ultimate portfolio outcome, the long-term results speak for themselves.