Perfect timing, a decade in the making…

Global emerging markets are currently touching multi-decade valuation lows compared to their developed market peers. After ten years of underperformance relative to high-flying tech and US markets, global investor allocations to Global Emerging Markets have slid to multi-year lows. Meanwhile, emerging markets account for over 40% of global GDP, contain over half the world’s population, have healthier demographics and near-term real GDP growth prospects versus developed markets, and yet comprise only 10% of global stock market capitalization. In the coming decades, the importance of emerging countries in the world economy is only expected to grow – with the 7 biggest emerging markets expected to account for 50% of world GDP by 2050, while the G7 is expected to extend its decline to 20%.

For anyone with a contrarian bone in their body, this is already a very interesting starting point. But it is further compounded by two other important factors which have historically accompanied EM outperformance: the US Dollar and commodity prices. King Dollar remains at extreme highs against most emerging market currencies currently, and there are some very good reasons for why this might turn from a headwind to a tailwind in the coming years. Despite encountering short-term cyclical challenges, the outlook for commodities broadly remains constructive, due to several factors, including a dearth of investment and a limited inflow of new supply.

From our vantage point, the long-term outlook for equity returns in emerging markets would appear excellent from such a starting point, and even more so for investors who are able to sift through and acquire the truly high-quality businesses able to re-invest capital at high rates of return.

While it looks like we have timed the launch of the Steyn Capital Global Emerging Markets Fund to coincide with this attractive backdrop, the strategy has taken almost a decade of continuous work to ready for launch, and we are extremely proud that it will be launching in October of this year.

Proprietary screen for ‘Quality Value’

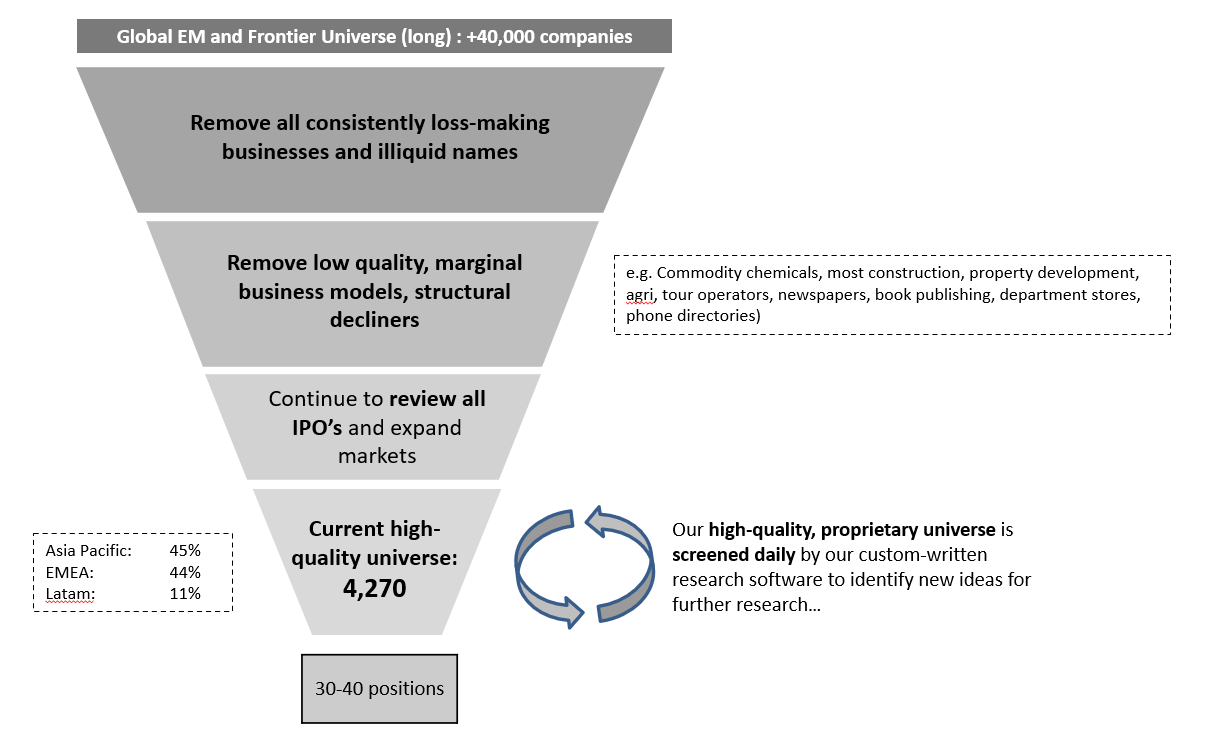

Core to our fundamental research process is our proprietary idea generation investment screen, with methodology grounded in academic research, which ranks the best investment prospects in our universe for further research, based on proprietary quality and value factors. The challenge of running such a screen across global EM is that the universe consists of over forty-thousand listed companies, many of which simply don’t meet our strict quality criteria.

So, starting in 2013, our team embarked on a process of examining, on a market-by-market basis, the business models of every company in every EM market to create a universe of exclusively higher-quality companies. Over a decade, our team has reviewed the business models and earnings drivers of over forty-thousand companies, discarded the vast majority and included into our screen only those companies that met our strict criteria.

That our team thoroughly enjoyed this process speaks something to our firm’s DNA. The result is something of which we are truly proud: an ultra-high quality and truly proprietary universe of 4,270 companies, whose financial data is scrubbed and screened daily to identify the best candidates for further research work.

This starting point gives us a wonderful competitive advantage in identifying the best prospective businesses to then run through our rigorous 15-step investment approach. The process, philosophy and investment-engine are exactly the same as we apply in our award-winning South Africa, African and Frontier strategies, emphasizing intensive fundamental research, forensic accounting analysis to ensure integrity of accounting, primary research and an assessment of the investee company’s ability to sustainably compound capital at high rates of return.

Our screen, specific investment focus and rigorous process gives us the ability to effectively and efficiently run a global strategy such as this, without the need for ‘boots on the ground’ in every market. Our investment process is further supported by the same macro-economic risk management overlay which has been so successful in navigating the complexities of African and Frontier markets, and our investment and operational teams’ experience in managing mandates across Africa, Global and Frontier markets.

The last decade has set the stage for a compelling multi-year opportunity in emerging markets, but quality is also crucial in navigating the invariable bumps in the road. Our work over the last decade to identify these businesses, we believe, makes the current starting point even more compelling.

The Steyn Capital Global Emerging Markets Fund is a Section 65 approved offshore UCITS Fund and will be launched in October, with a minimum investment of $1,000.

If you’d like to learn more, please do contact us at www.steyncapitalmanagement.com or jamie@steyncapitalmanagement.com, or on 021 001 4682