If we look at huge companies like Microsoft and Apple, we can see that they have moved from once-off to ongoing revenue (we used to buy Office on a CD but now subscribe to Office 365). They have done this because subscription models create ongoing or passive income. This means that these companies now get paid over and over for the same sale, resulting in higher earnings over the medium to long term.

Ongoing income also improves client loyalty, financial stability, growth potential and a higher practice valuation. Like Apple and Microsoft, financial planners with a high proportion of passive income tend to earn more over the long term, because passive income accumulates over time, unlike upfront commissions that are the result of a single year’s effort.

Empirically, when we looked at all the Fairbairn Consult advisors who earned over R1-million in 2024, we found that 78% of their income was ongoing, with only 22% once-off. In other words, the advisors who make the most money do so because they have a high proportion of ongoing income that builds up over time.

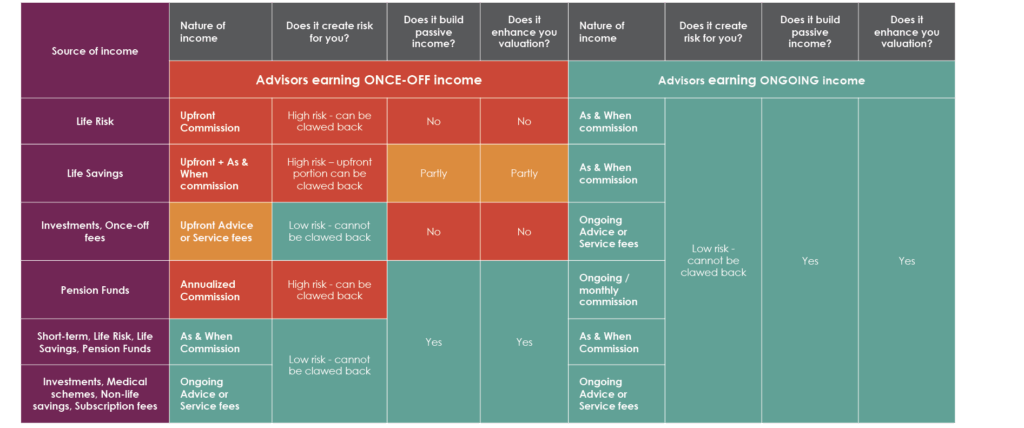

By considering different commission models, you can make the strategic shift from once-off to ongoing revenue for every line of business.

You can see that the upfront commission on life products is the worst because it creates the risk of clawbacks, does not build ongoing income (other than premium updates) and it does not contribute to your practice valuation. As a result, it is most important to shift from upfront to as-and-when commission on life products. To do this, you need to understand all the options from the different product providers, so that you can recommend the most appropriate solution to your clients, and, at the same time, ensure your own financial sustainability.

The conventional approach to transition from upfront commission to as-and-when is to take as-and-when commission on a portion of policies and to switch entirely to as-and-when after reaching a specific monthly income target. However, you can also consider a mix of as-and-when and upfront commissions, with a higher proportion of as-and-when for larger policies so that you mitigate the risk of clawbacks.

You can even game the system by taking as-and-when commission on policies that are either likely to lapse early or stay on books for a long time. Let me explain: while each product has slightly different as-and-when commission structures, they all result in higher net income than upfront commission for policies that lapse early because you do not get hit by a clawback. They also pay more over the long term because there is a built-in rate of return of around 15%. And don’t forget that as-and-when commission increases every year when the premiums increase.

By switching from once-off to ongoing revenue, you can derisk your business, earn a predictable monthly income that keeps growing and increase your practice valuation. While many advisors know this, it takes discipline and conviction to make one of the most important changes in your business.

One day or day one – you choose.