As the novel coronavirus (Covid-19) reaches pandemic proportions, and country after country follows the example of China in enacting widespread quarantines and shutdowns, it is natural to ask what the economic damage is likely to be. Every country’s experience will differ, depending on the choice of policy response.

In the interim, however, we can look to Chinese economic data for an idea of what to expect elsewhere. The country appears to have contained the outbreak, at least for now. To achieve this, the authorities enacted a near two-month shutdown of most of the economy, and restrictions seem unlikely to be fully relaxed for some time. There is still a risk of a resurgence of infection, either domestically or via imported cases.

The cost of containment

The cost of this approach is beginning to surface in the monthly data. We now have information on the economy’s perfor-mance in the first two months of the year, and it makes for grim reading. Wherever we look in the Chinese economy, we see double-digit declines. Particularly hard hit, as might be expected, has been consumption. Retail sales contracted 20.5% year-on-year (y/y) for the first two months of 2020. Online sales held up better but still recorded a decline of 3% y/y, having grown at a double-digit pace throughout 2019.

So while online shopping might be expected to prove more resilient than the bricks and mortar variety, even in e-commerce heavy China it is clear that Covid-19 still poses a serious headwind.

Industrial production was not as badly impacted, but this is very much only a relative position. A contraction of 13.5% y/y is still atrocious. Other parts of the non-service side of the economy meanwhile were in some cases worse hit still; fixed asset investment contracted by more than retail sales. This was partly due to a lack of demand, but also because of a lack of workers. Construction is hard to carry out when your workforce is under a mandatory 14-day quarantine.

Dramatic decline in first-quarter activity

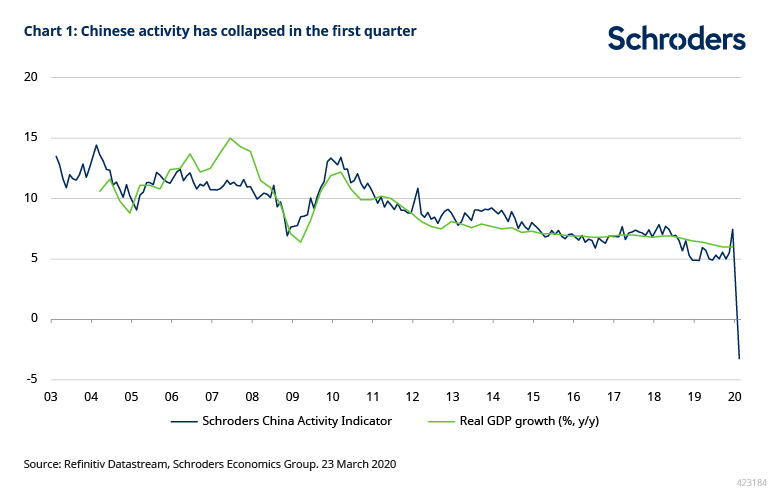

Combining these figures with the trade data (also bad) we can update our inhouse Chinese economic growth tracker, the Schroders China Activity Index (SCAI).

Previously running at a very robust 7% at the end of 2019 as activity accelerated, this has now collapsed to a contraction of over 3% y/y (Chart 1).

As ever, the question with China is whether we can trust the data. The monthly data is unquestionably bad, but might it be even worse? On a quarterly basis, we can provide a reasonable estimate, ex ante, of what the shutdown in China should have done to activity. That is, we know the number of working days lost in the first quarter relative to the final quarter of last year, and roughly the share of the economy this applied to. The total number of days is fairly easy to work out from official announcements; the share of the economy is trickier. Even at the height of the quarantine, it was never the case that 100% of activity was shutdown.

We also had a slow extension of the quarantine to more and more of the economy over time (and a gradual relaxation from the start of March).

The measures taken so far seem to have been reasonably effective at limiting bankruptcies and layoffs, which is the response Western economies are still struggling to configure.

On a province by province basis, Hubei, China’s outbreak epicentre, was shut down first. Additional provinces shut down (extending Lunar New Year holidays) a few at a time until all of China had imposed measures. In most cases, essential services were kept open. So let us assume that at its worst, the shutdown incorporated as much as 80% of Chinese GDP and that on average around 70% of the economy was shut down in Q1 for 30 days. That points to a 32.8% q/q decline in activity.

Currently, our SCAI measure is on track for a 27% q/q decline. To us, that is close enough to suggest that official data, at least on a monthly basis, does reflect reality.

This leaves us in something of a quandary when it comes to forecasting. Historically, we have assumed minimal deviation from the announced growth target in the official GDP data, given China’s pursuit of a doubling of incomes by 2020. While we now see this goal being missed, even in the official numbers, we remain uncertain as to how much of a miss the authorities will tolerate.

We do expect official data to report a weak first quarter, but still see it as being a low positive, followed by a strong rebound and a victory in the “people’s war” over the virus. Currently, as a result, we still forecast a 5% growth for this year. However, we are certainly alive to the risk that the monthly data for the start of the year reveals a greater willingness to face economic reality.

We think if GDP is allowed to more closely reflect the monthly data, Chinese GDP is likely to come in at around 3% for 2020 as a whole, assuming no further outbreaks of Covid-19.

Muted reaction from policymakers

The policy response so far seems to hint at little concern over slower growth. Total fiscal stimulus so far amounts to around 1.2% of GDP, directed mainly through reductions to corporate fees and taxes, and some emergency spending. The People’s Bank of China (PBoC) has been active in providing ample liquidity, and has eased policy marginally via the odd 10 bps cut to policy rates and a recently targeted RRR cut, but is a noticeable outlier vs other major central banks.

There are multiple schools of thought on how to interpret this. One is that the authorities are content to allow slower growth this year. This may be true, but even if so we think more stimulus is needed to provide a modest level of growth – our forecast of true activity around 3% for 2020 incorporates a total fiscal outlay of 4%, for example.

It might instead be the case that so far, the authorities had proceeded on the basis that the outbreak would not impact the rest of the world too badly, and so China could count on a sharp V-shaped recovery aided by buoyant global demand. That is no longer the case, but the policy response is lagging in part because the virus has meant that the annual policy meeting has been delayed. Local governments have announced some ambitious plans for infrastructure spending, but await sign-off from the centre to issue the bonds needed to finance it.

Managing the recovery

There is also likely debate about the best way to provide stimulus, in China as elsewhere. The measures taken so far seem to have been reasonably effective at limiting bankruptcies and layoffs, which is the response Western economies are still struggling to configure. The next step is how to inject demand. Consumption has undoubtedly cratered hard, so handouts to consumers might seem attractive. However, if consumption is weak because confidence is weak, rather than because incomes have fallen (our assumption), then giving households more money to spend might just see an increase in saving.

This has parallels with corporate tax cuts – there is no way to ensure a VAT cut, for example, is passed on to the final consumer. Instead, if the state wants to immediately boost demand, the best way might be to increase infrastructure spending.

While the projects may not be as efficient as hoped, they do offer an immediate source of demand for raw materials and labour and thereby a boost to demand. This is our expectation.

For all that China is often portrayed as a monolith, we know that the PBoC and Ministry of Finance are often at odds over policy, and the same is likely true now. Concerns over debt will no doubt be prominent, for example, and the household sector is typically seen as the lowest risk option in this area. Whatever China chooses, as with its initial virus response, it will prove a useful case study for anxious governments the world over.

Schroders Investment Management Ltd registration number: 01893220 (Incorporated in England and Wales) is authorised and regulated in the UK by the Financial Conduct Authority and an authorised financial services provider in South Africa FSP No: 48998

Featured image: iStock