Markets are intrinsically volatile and for investors making regular withdrawals, this volatility is particularly relevant. If the value of your retirement savings falls near the outset of drawing an income, the amount withdrawn will represent a bigger portion of your investment than if your savings had grown over this period.

The impact is that the base continues to decline with each additional withdrawal, leaving less savings to grow. The risk involved in withdrawing money from a volatile portfolio, termed sequence-of-return-risk, is lower when portfolio volatility is lower. The recent market capitulation has highlighted the value of having the right mix of portfolios in reducing this type of risk without compromising too much on longer-term growth.

The 36ONE hedge funds can produce positive returns in both rising and falling equity markets (due to their combination of long and short positions). Investing in the 36ONE hedge funds can limit the impact of market volatility on a portfolio and reduce sequence-of-return risk.

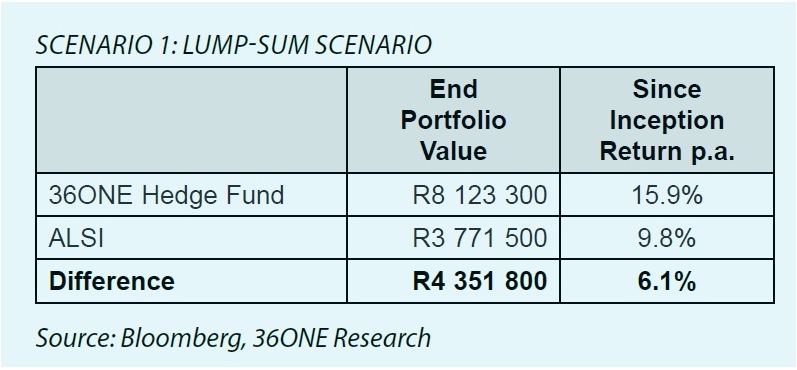

Example: An investor with a R2-million lump sum invests R1-million in the 36ONE SNN QI Hedge Fund (36ONE Hedge Fund) and R1-million in the FTSE/JSE All-Share Index (ALSI) at the start of April 2006 (36ONE Hedge Fund launch date). The table summarises portfolio values on May 31 2020 in nominal terms:

The client would have been substantially better off if he had invested the full lump-sum amount in the 36ONE Hedge Fund, as the hedge fund outperformed the ALSI by 6.1% per year over the period.

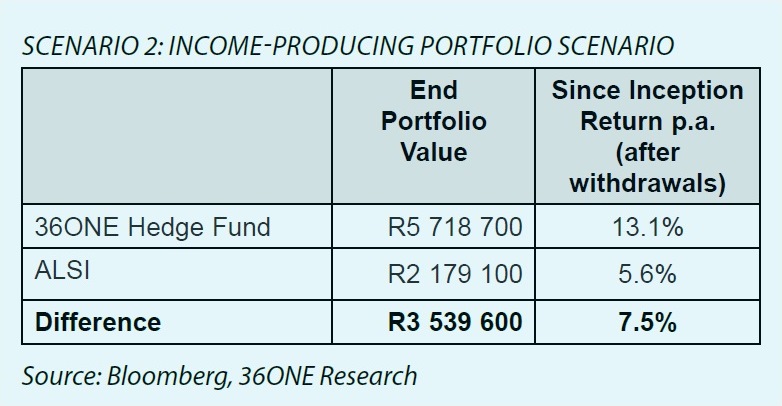

Extending the example: Assume that he invested the R2-million but needs to draw R7 500 monthly, increasing at 6% p.a. The table summarises portfolio values on May 31 2020 in nominal terms:

When you compare the end values of the income-producing portfolios, the 36ONE Hedge Fund outperformed the ALSI by 7.5% a year. This is higher than the lump sum scenario where the 36ONE Hedge Fund outperformed the ALSI by 6.1% a year.

The reason for this is simply volatility. Over the +14 years, the 36ONE Hedge Fund was substantially less volatile than the ALSI. The hedge fund also experienced much lower drawdowns during the period.

While the above scenarios are simplified, they show the impact of volatility on income-producing portfolios.

As is evident, higher volatility can act as a drag on performance in income-producing portfolios and can result in clients not meeting their income objectives over the lifespan of their retirement. We are living longer, which means time in retirement is longer and therefore more money is needed. Having to draw an income from your retirement savings for longer needs an appropriate investment strategy.

DISCLAIMER:

Source: Bloomberg, 36ONE Research; Performance to 31 May 2020. The information presented here is not intended to be relied upon for investment advice. Various assumptions were made. See our full disclaimer here: https://www.36one.co.za/articles/disclaimer