We find ourselves amid a pandemic that has had a profound short-term impact not only on our daily lives but virtually every other aspect of life including the hard-earned savings of our clients. The period from 17 February 2020 to 19 March 2020 saw a staggering meltdown in equity markets as the JSE All Share Index (ALSI) lost 30.3% in just 23 trading days and the S&P 500 lost 33.7% in US dollars over a similar period.

As a financial advisor, your clients look to you for answers to their burning questions. When will life return to normal? How does South Africa come out of this? Is my financial plan still on track given the Covid-19 crash or should I take further action?

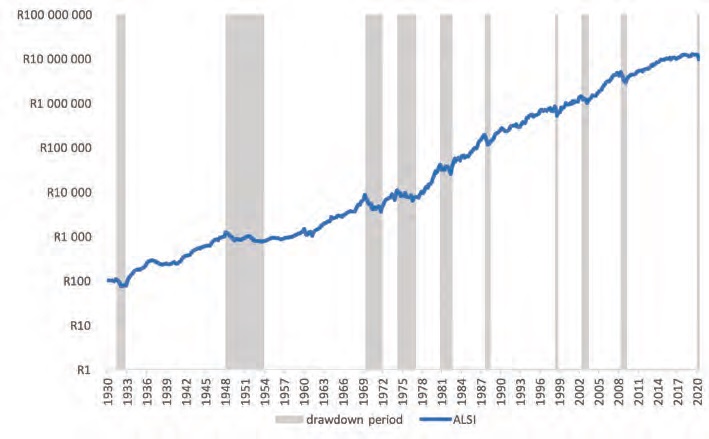

It is often useful to look to history for context. This is easier said than done during a crisis when the natural response is to act first and to think only about the short term. Winston Churchill famously said, “The farther back you can look, the farther forward you are likely to see.” The chart below illustrates previous crises against the long-term performance of the ALSI over the last 90 years. It is plotted on a log scale to make the relative sizes of each highlighted drawdown more comparable visually.

The chart contains a few very obvious observations. The first of which is that equities have been an extraordinary investment over the last 90 years during which the ALSI compounded by 13.6% p.a. in nominal terms – meaning that every R100 invested in 1930 would be worth R9.8-million today.

The second obvious point is that the market has had several periods of significant drawdowns as shown by the highlighted sections. The final observation is that while the Covid-19 crash has been rapid in its punishment of equities, the size of the drawdown is not unique. Looking at each highlighted period individually makes for interesting reading.

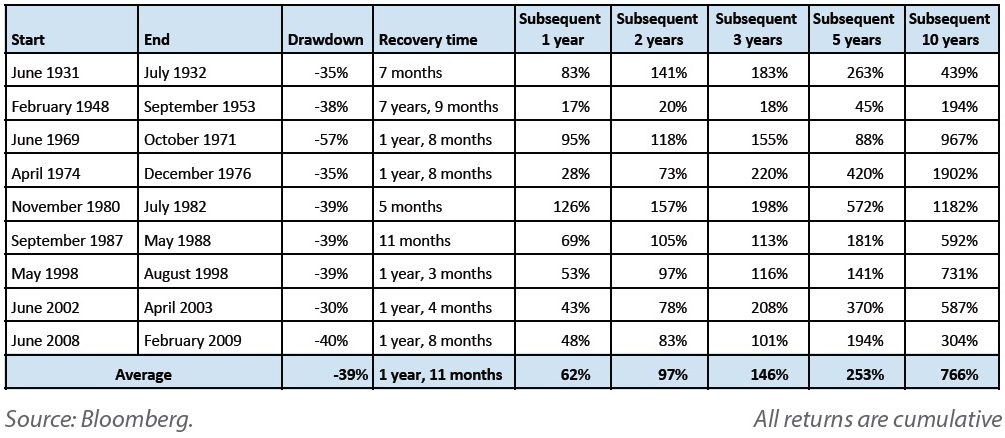

Consider the table above that quantifies the previous drawdowns, the time it took to recover from the sell-off and the subsequent returns over the short, medium and long term. The periods highlighted in the table represent an average drawdown of -39% with an average time to recovery of less than two years.

As one can expect after a period where asset prices reduce by such a meaningful amount, the subsequent long-term performance was very strong, with investors gaining 2.5 times and almost 7.7 times their investment on average over the subsequent five and 10 years respectively.

In the month following the unprecedented meltdown in equities due to the Covid-19 pandemic, the ALSI had recovered by 30.4% off its lows of 19 March, while the S&P 500 was up 28.7% in US dollars. History may not repeat itself, but it may well prove once again to rhyme.