Alternative energy fund launched

A R400-million Energy Fund designed to cater to small to medium-sized enterprises (SMEs) who need to find ways of keeping their businesses supplied with power has been created by Business Partners Limited, says Executive Director, Jeremy Lang.

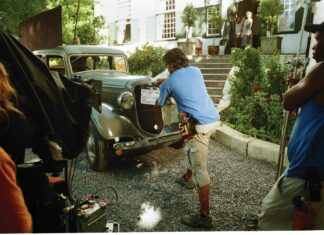

Creative industries are growing the economy

South Africa’s cultural creative industries have seen a rise in activity and economic contribution in recent years. The direct impact (also called Value Added) of the CCIs in 2018 was $5.51-billion, accounting for 1.7% of GDP (compared to 1.5% in 2016). Taking the Direct Effect, Indirect Effect, and Induced Effect into account, the CCIs’ total effect on the economy was $18.01-billion, or 5.6% of the country’s GDP.

What does the rise in bond yields mean for the economy?

A major sell-off in bond markets has seen yields hit levels not reached for 15 years or more. We look at the implications and ask if it will cause something to break in the economy, says Keith Wade, Chief Economist and Strategist, Schroders

Investing in building a Global Smart City – Johannesburg

Global Cities shoulder the responsibility of leading the economic growth of a nation. Johannesburg is the Global City of not only South Africa, but of the SADC region.

Driving digital inclusion

Convergence Partners Digital Infrastructure Fund beat its target and closed at $296-million in 2023, says Andile Ngcaba, Chairman and Founding Partner of Convergence Partners.

Digital exchange platform will make freight rail more efficient

A

substantial percentage of all rail wagons in South Africa are empty when moving between destinations. In the SADC region, only a small percentage of rail capacity is being fully utilised. That is a huge amount of wasted and expensive space, says Andrew Crafford, Managing Executive, Empty Trips.

Time for SA consumers to tighten belts and avoid debt

The recent increase in the repo rate, combined with steep increases in fuel and energy prices, points to a torrid time ahead for South African consumers – but the short-term discomfort should pay off in the long term, says employee benefits advisor firm NMG Benefits.

The gender pay gap is still an uncomfortable reality

The Oribi incubation model helps women discover economic freedom through collective networks and entrepreneurship development.

Why we’ve slashed our Chinese growth forecast

Economic forecasting can be a thankless task, and the latest round of revisions to our expectations for China came with a large portion of humble pie, says David Rees, Senior Emerging Markets Economist, Schroders

Riding forward to a green future in Africa

Electric motorcycles are set to be a dominant force in Sub-Saharan Africa’s sustainable mobility transformation, but continued investment in startups tackling barriers across the value chain will be critical to maximise the full potential, says a report recently released by the Powering Renewable Energy Opportunities (PREO) programme.

Most Popular

VISION 2030

Blue Chip speaks to the Financial Planning Institute of Southern Africa’s CEO, Lelané Bezuidenhout, about winning the FPSB 2025 Noel Maye Award for outstanding contributions to the profession as well as the FPI’s new Vision 2030 strategy.

Protecting independent financial advice

The Financial Intermediaries Association of South Africa’s primary purpose is to guard, develop, promote and represent professional advisory and intermediary businesses in the financial services industry. Blue Chip speaks to Lizelle van der Merwe, CEO of the FIA.

The Intelligent Adviser’s Playbook: PROpulsion hosts 2026 Practice Management Conference

A practical virtual conference for financial planning businesses that want to run smarter operations, without adding unnecessary risk or complexity.

PROpulsion Practice Management Conference 2026

The 2026 PROpulsion Practice Management Conference focuses on how advisers and their teams can use intelligent tools, including AI, in practical, defensible ways that improve efficiency, consistency, and client experience.

When clients ask if they have done enough

Kobus Kleyn (CFP®, Tax and Fiduciary Practitioner, Kainos Wealth) writes about understanding vulnerability in financial advice.